Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları Konusunda kafanız karışıkmı?

Editörün Notları: Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları bugünün tarihine kadar yayınlanmıştır. Çünkü bu konu üzerinde bilgi sahibi olmanız çok önemlidir.

Bu alanda oldukça fazla analizler yapıp, araştırmalar yapıp, Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları hakkında pek çok veriyi bir araya getirerek sizlere Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları rehberi sunuyoruz. Bu sayede sizler bilgiler edinerek en doğru kararı verebilecek durumuna geleceksiniz.

FAQs about Housing Loan Interest Rates

This FAQ section provides detailed information about housing loan interest rates and answers common questions consumers may have.

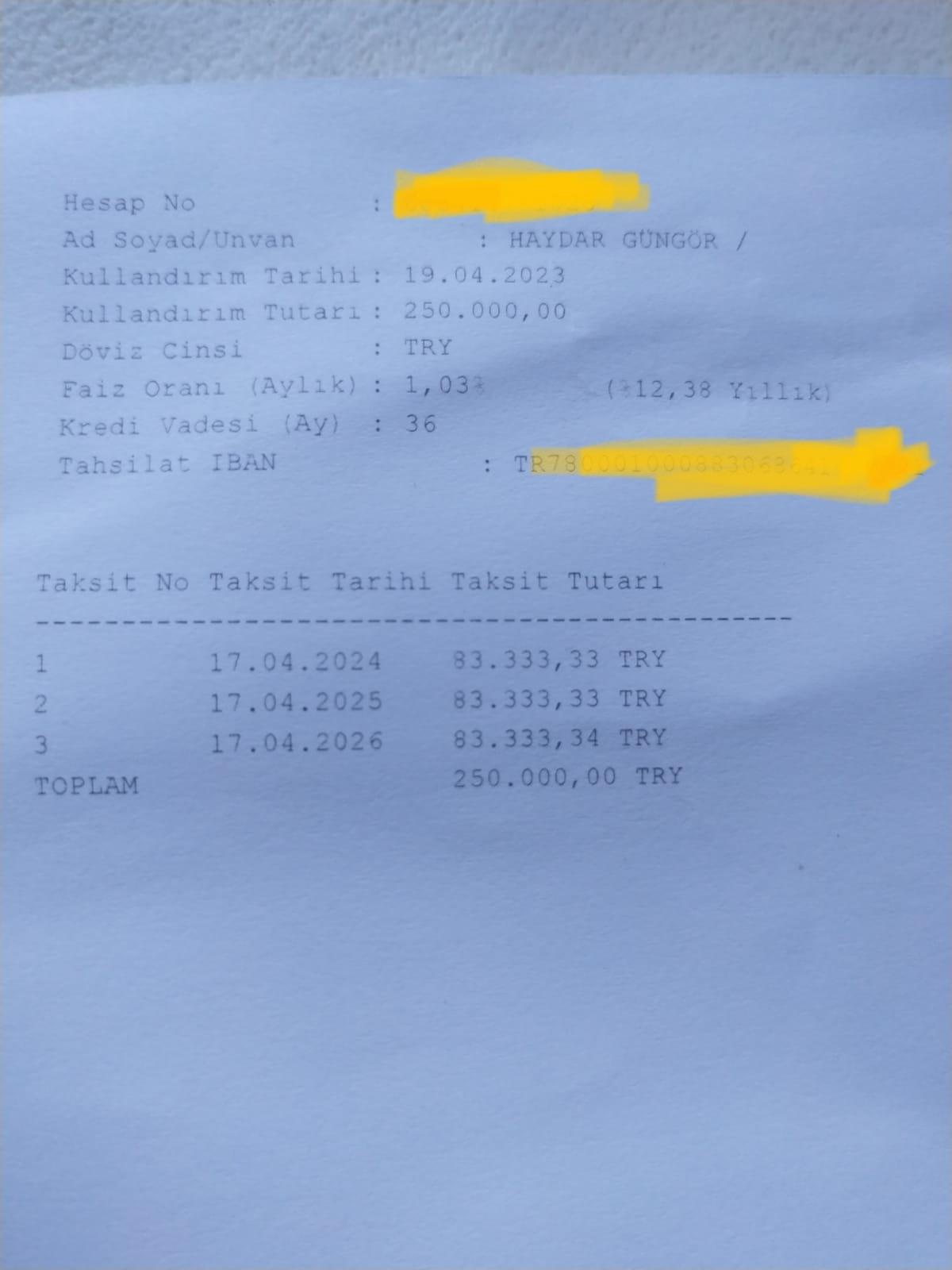

Ziraat Bankası 250000 TL Çiftçiyi Destekleme Kredisi Faiz Oranları - Source www.sikayetvar.com

Question 1: What are the different types of housing loan interest rates?

There are two main types of housing loan interest rates: fixed and variable. Fixed interest rates remain the same throughout the loan term, while variable interest rates can fluctuate based on market conditions.

Question 2: Which type of interest rate is better for me?

The best type of interest rate for you depends on your individual circumstances and risk tolerance. Fixed interest rates provide stability and predictability, while variable interest rates can offer the potential for lower payments if rates decline.

Question 3: How can I get the best interest rate on a housing loan?

To secure the best interest rate, it's important to compare offers from multiple lenders, maintain a good credit score, and explore government-backed loan programs that may offer lower rates.

Question 4: What are the factors that affect housing loan interest rates?

Interest rates are influenced by a range of factors, including economic conditions, inflation, and the central bank's monetary policy.

Question 5: Can I refinance my housing loan to get a lower interest rate?

Refinancing can be a viable option to lower your interest rate and monthly payments, but it involves fees and closing costs. It's crucial to carefully assess the potential benefits against the costs.

Question 6: What are the risks of taking out a housing loan with a variable interest rate?

Variable interest rates carry the risk that payments could increase if rates rise. It's essential to consider your financial situation and tolerance for risk before opting for a variable rate loan.

Remember, it's advisable to consult with a financial advisor or loan officer to determine the right housing loan options and interest rates for your specific needs.

Proceed to the next section for further insights into housing loans.

Tips for Home Loans

To land the most ideal financing for your dream home, these crucial tips will provide you with invaluable guidance. Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları and make wise choices throughout your mortgage journey.

Tip 1: Enhance Your Credit Profile

A substantial credit score signifies your capacity for responsible financial management. Aim for a score of 740 or above to secure a favorable interest rate. Regularly check your credit reports and rectify any errors or negative items.

Tip 2: Reduce Debt-to-Income Ratio

The percentage of your monthly income allocated to debt repayments is known as the debt-to-income ratio. Lower this ratio by paying down existing debts or increasing your income, improving your chances of mortgage approval and a more favorable interest rate.

Tip 3: Lock in a Fixed Interest Rate

Fixed interest rates provide peace of mind, as your monthly payments remain constant throughout your loan term, shielding you from potential fluctuations in the market. Lock in a fixed rate when interest rates are historically low to secure long-term savings.

Tip 4: Make a Substantial Down Payment

A larger down payment means a smaller loan amount and potentially a lower interest rate. Aim to put down at least 20% of the home's purchase price to avoid private mortgage insurance (PMI).

Tip 5: Compare Multiple Lenders

Don't settle for the first mortgage offer you receive. Reach out to various banks, credit unions, and online lenders to compare interest rates, loan terms, and fees. Choosing the most competitive option can save you thousands of dollars in the long run.

Tip 6: Get a Pre-Approval

Before you start house hunting, obtain a pre-approval from a lender. This provides you with a maximum loan amount and demonstrates to sellers that you are a serious buyer, strengthening your negotiation position.

Tip 7: Be Prepared to Negotiate

After finding your dream home, don't hesitate to negotiate with the lender. Inquire about reducing closing costs or securing a lower interest rate. Good preparation and a willingness to compromise can lead to significant savings.

Tip 8: Read and Understand Loan Documents

Before signing any mortgage documents, meticulously read and comprehend the conditions. Seek clarification from the lender if there are any terms you don't understand. This ensures you are fully aware of your responsibilities and rights as a homeowner.

By implementing these tips, you can considerably strengthen your application, secure the best possible mortgage terms, and embark on your homeownership journey with confidence and financial stability.

Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları

Konut kredisi faiz oranları, ev satın alma maliyetini doğrudan etkileyen önemli bir faktördür. Bu oranlar, ekonomik koşullar, bankaların risk algısı ve hükümet politikaları gibi çeşitli unsurlardan etkilenebilir. En güncel bilgileri ve bu oranları yönetmek için faydalı ipuçlarını anlamak, bilinçli kararlar vermenize yardımcı olabilir.

- Mevcut Faiz Oranları: Mevcut faiz oranlarının araştırılması, mevcut borçlanma ortamını anlamanızı sağlar.

- Piyasa Trendleri: Faiz oranlarında geçmiş ve beklenen değişiklikleri takip etmek, gelecekteki eğilimleri tahmin etmenize yardımcı olur.

- Bankaların Farklılıkları: Farklı bankalar, risk profilinize ve mali durumunuza bağlı olarak farklı faiz oranları sunabilir.

- Sabit ve Değişken Oranlar: Faiz oranı türünü seçmek, mali durumunuza ve risk toleransınıza göre değişir.

- Ek Ücretler: Faiz oranının yanı sıra, ipotek sigortası ve kapanış maliyetleri gibi ek ücretleri de göz önünde bulundurmalısınız.

- Müzakere Yapma: Kredi notunuz ve borç-gelir oranınız gibi faktörleri vurgulayarak daha düşük faiz oranı müzakere etmeyi deneyebilirsiniz.

konut kredisi faiz oranları | Uygun Konut Kredileri - Source www.kupahaber.com

Konut kredisi faiz oranlarını anlamak, bilinçli finansal kararlar vermek için çok önemlidir. En güncel bilgileri araştırmak, piyasa trendlerini takip etmek ve farklı bankaları karşılaştırmak, sizin için en iyi seçimi yapmanıza yardımcı olabilir. Ek ücretleri göz önünde bulundurarak ve faiz oranınızı müzakere ederek, konut kredisi maliyetlerinizi en aza indirebilirsiniz.

Konut Kredisi Faiz Oranları: En Güncel Bilgiler Ve İpuçları

Mortgage interest rates are a crucial factor in determining the monthly payments and overall cost of a home loan. They can significantly impact the affordability and accessibility of housing, especially for first-time homebuyers. Understanding the factors that influence mortgage rates and the current market conditions is essential for making informed decisions about purchasing a home. This article provides an in-depth analysis of mortgage interest rates, including the latest updates, expert insights, and practical tips to help borrowers navigate the complex home financing landscape.

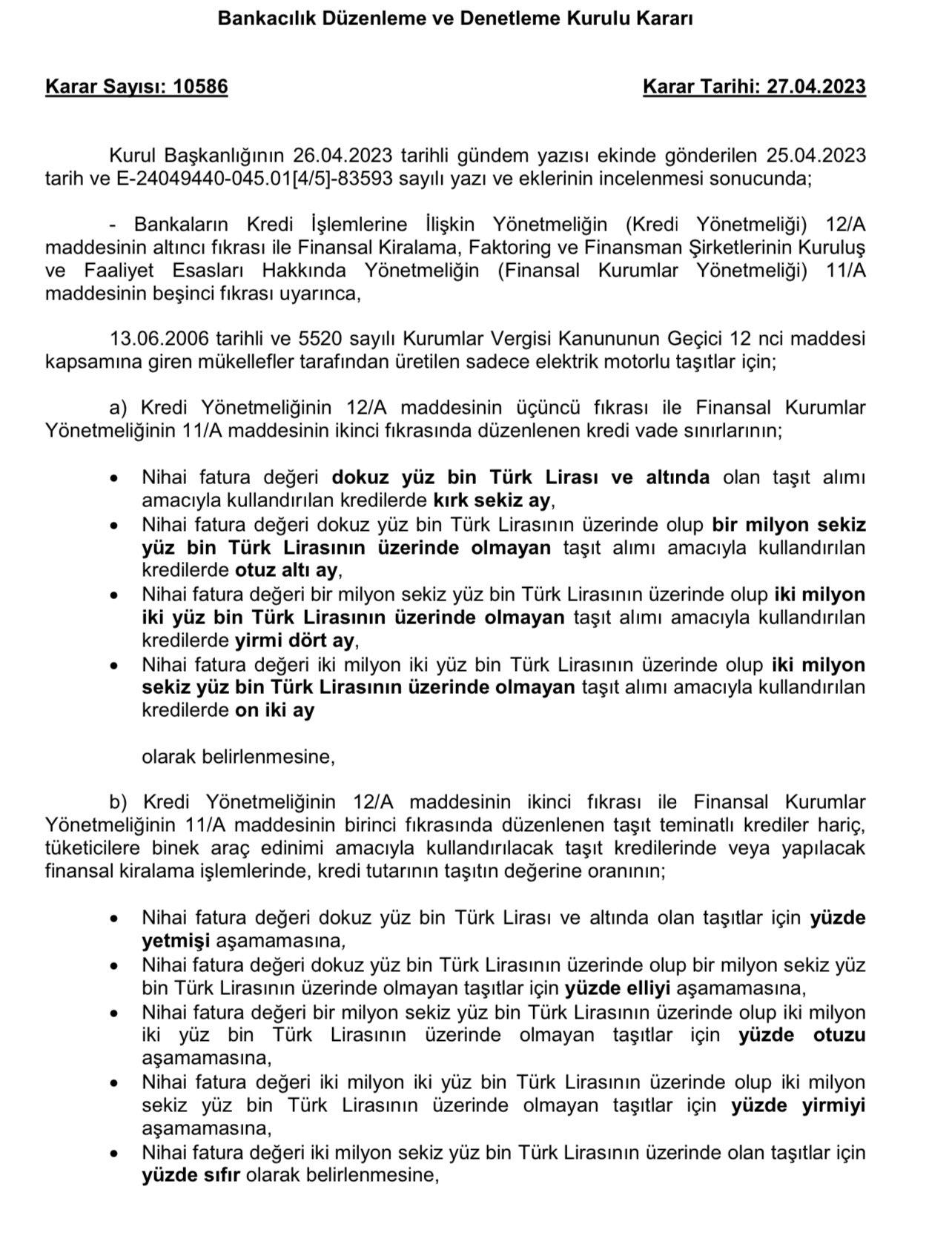

Araba alacaklara taşıt kredisi müjdesi geldi: İşte kredi faiz oranları - Source www.finans7.com

Mortgage interest rates are determined by a combination of economic, financial, and market factors. The most significant factor is the benchmark interest rate set by central banks, such as the Federal Reserve in the United States. Central banks adjust interest rates to manage inflation, economic growth, and financial stability. When inflation is high, central banks typically raise interest rates to cool down the economy and curb price increases. Conversely, when the economy slows down, central banks may lower interest rates to stimulate growth and encourage borrowing.

In addition to the benchmark interest rate, mortgage rates are also influenced by the lender's risk assessment of the borrower. Factors such as credit score, debt-to-income ratio, and loan-to-value ratio play a significant role in determining the interest rate offered to a borrower. Borrowers with higher credit scores and lower debt-to-income ratios typically qualify for lower interest rates. Similarly, borrowers who put down a larger down payment and have a smaller loan-to-value ratio are considered less risky and may receive more favorable interest rates.

The current mortgage rate environment is characterized by historically low rates. However, it is important to note that rates can change quickly in response to economic and market conditions. Borrowers considering a mortgage should carefully consider their financial situation and long-term goals to determine the best time to lock in a rate.

| Interest Rate | Loan Amount | Monthly Payment |

|---|---|---|

| 3.50% | $200,000 | $936 |

| 4.00% | $200,000 | $992 |

| 4.50% | $200,000 | $1049 |