Premium Bonds: Secure Savings With Tax-Free Prizes

Editor's Notes: "Premium Bonds: Secure Savings With Tax-Free Prizes" have published today.

After analyzing reviews, we put together this Premium Bonds: Secure Savings With Tax-Free Prizes guide to help you make the right decision.

Key differences or Key takeways, provide in informative table format

Transition to main article topics

FAQ

Delve into frequently asked questions (FAQs) related to Premium Bonds, a secure savings option that offers tax-free prizes.

Question 1: How does one purchase Premium Bonds?

Premium Bonds can be purchased through the National Savings & Investments (NS&I) website, over the phone, or by post. The minimum investment amount is £25, and there is no maximum limit.

Question 2: Are Premium Bonds a type of lottery?

No, Premium Bonds are not a lottery. They are a savings product that offers the chance to win tax-free prizes. The prizes are drawn monthly, and the odds of winning depend on the number of bonds held.

Question 3: How much interest do Premium Bonds earn?

Premium Bonds do not earn interest in the traditional sense. Instead, they offer the chance to win tax-free prizes. The prize fund is generated from interest earned on investments made by NS&I.

Question 4: What are the chances of winning a prize with Premium Bonds?

The odds of winning a prize with Premium Bonds depend on the number of bonds held. For example, with £100 worth of bonds, the chances of winning any prize in a month are approximately 1 in 24,000.

Question 5: Are Premium Bonds a good investment?

Premium Bonds are a low-risk savings option that offers the chance to win tax-free prizes. They are not a traditional investment, but they can be a good way to save for the future while also having the chance to win.

Question 6: How are Premium Bond prizes paid out?

Premium Bond prizes are paid out electronically into the winner's bank account. Winners are notified by post or email.

By understanding these FAQs, one can make informed decisions about investing in Premium Bonds and potentially enjoy the benefits of tax-free savings and the excitement of winning prizes.

Can You Buy Premium Bonds At The Post Office - Buy Walls - Source buywalls.blogspot.com

Tips

Maximizing returns and managing potential risks associated with Premium Bonds: Secure Savings With Tax-Free Prizes requires careful planning and consideration. Below are a few tips to make the most of Premium Bonds while safeguarding your savings:

Tip 1: Set realistic expectations. While Premium Bonds offer the potential for tax-free wins, it's essential to recognize that they are not a guaranteed investment. Bonds are drawn randomly each month, and the odds of winning a large prize are relatively low.

Tip 2: Diversify your savings. Premium Bonds should form part of a diversified savings portfolio, alongside other investments such as stocks, bonds, and cash savings. This approach helps spread risk and potentially enhance overall returns.

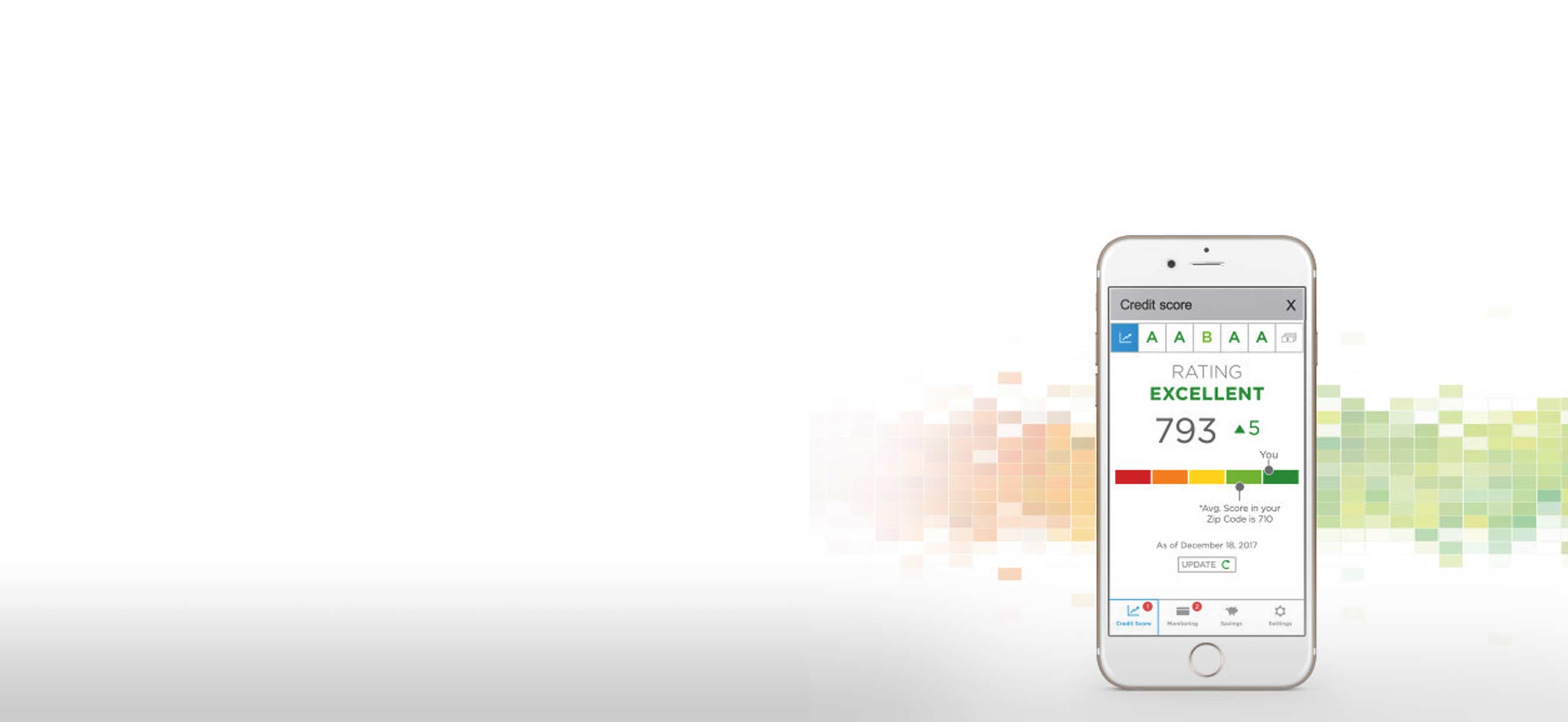

Ns&i Premium Bonds Checker - Source tracimckenzie143news.blogspot.com

Tip 3: Maximize holdings. The more Premium Bonds you hold, the higher your chances of winning. However, it's important to strike a balance between maximizing your chances and ensuring you have a diversified portfolio.

Tip 4: Retain winnings. Resist the temptation to cash out winnings immediately. Reinvesting prizes increases your overall holdings and potential for future wins.

Tip 5: Monitor your account regularly. Keep track of your winnings and make informed decisions about managing your savings and investments.

Premium Bonds: Secure Savings With Tax-Free Prizes

Premium Bonds offer a unique combination of secure savings and the chance to win tax-free prizes. The six key aspects that make Premium Bonds a compelling investment choice include:

- Government-Backed: Premium Bonds are backed by the UK government, providing peace of mind.

- Zero Risk: Unlike stocks or shares, Premium Bonds carry no risk of losing capital.

- Tax-Free Prizes: Any prizes won from Premium Bonds are completely tax-free.

- Regular Draws: Prize draws are held monthly, giving you multiple chances to win.

- Easy to Manage: Premium Bonds can be purchased and managed online or through the post.

- Ethical Investment: Premium Bonds support a range of good causes, making them an ethical investment.

Together, these aspects make Premium Bonds a highly secure and rewarding savings option. They provide a guaranteed return on your investment, with the added excitement of the chance to win tax-free prizes. Whether you're looking for a low-risk way to save or simply want to add some excitement to your savings, Premium Bonds are an excellent choice.

US Savings Bonds Logo PNG Transparent & SVG Vector - Freebie Supply - Source freebiesupply.com

Premium Bonds: Secure Savings With Tax-Free Prizes

Premium Bonds offer a unique combination of security, tax-free prizes, and accessibility, making them an attractive savings option for those seeking a low-risk, low-return investment. The connection between these elements is crucial, as it highlights the benefits of investing in Premium Bonds and differentiates them from other savings products.

Security Savings Bank | Monmouth & Stronghurst, IL - Source www.securitysavings.com

Premium Bonds are issued by the UK government and backed by the National Savings & Investments (NS&I), ensuring their safety and reliability. Unlike traditional savings accounts, which offer fixed interest rates, Premium Bonds rely on a monthly prize draw, with the chance to win tax-free prizes ranging from £25 to £1 million. This prize structure provides an element of excitement and potential financial gain, while still preserving the security of the initial investment.

The tax-free nature of Premium Bond prizes is a significant advantage, particularly for higher-rate taxpayers. Unlike interest earned on savings accounts, which is subject to income tax, Premium Bond prizes are completely tax-free, making them an appealing option for those seeking to maximize their returns.

Furthermore, Premium Bonds are highly accessible, with a minimum investment of just £25 and no upper investment limit. This makes them suitable for a wide range of investors, from first-time savers to those with substantial savings. The ease of investing in Premium Bonds, combined with their potential for tax-free returns, makes them a compelling choice for those seeking a secure and potentially rewarding savings option.

In conclusion, the combination of security, tax-free prizes, and accessibility makes Premium Bonds an attractive savings option for those seeking a low-risk, potentially rewarding investment. The unique features of Premium Bonds differentiate them from other savings products and provide investors with a valuable tool for diversifying their portfolios.