HMRC has issued a warning to those considering taking money out of their pension pot too early.

Editor's Note: "Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early" was published on [insert date]. This topic is important to read because it provides information on how to avoid paying unnecessary taxes on your pension savings.

We've analyzed the information and dug into the details, and we've put together this guide to help you make the right decision about when to take money out of your pension pot.

| Age | Tax-free cash | Income tax |

|---|---|---|

| Before 55 | 25% | Up to 55% |

| After 55 | 25% | Up to 20% |

FAQ

If you are considering taking money out of your pension pot, it is essential to be aware of the potential tax implications. HMRC has warned that taking money out too early could result in significant tax charges. Here are some frequently asked questions and answers to help you understand the rules:

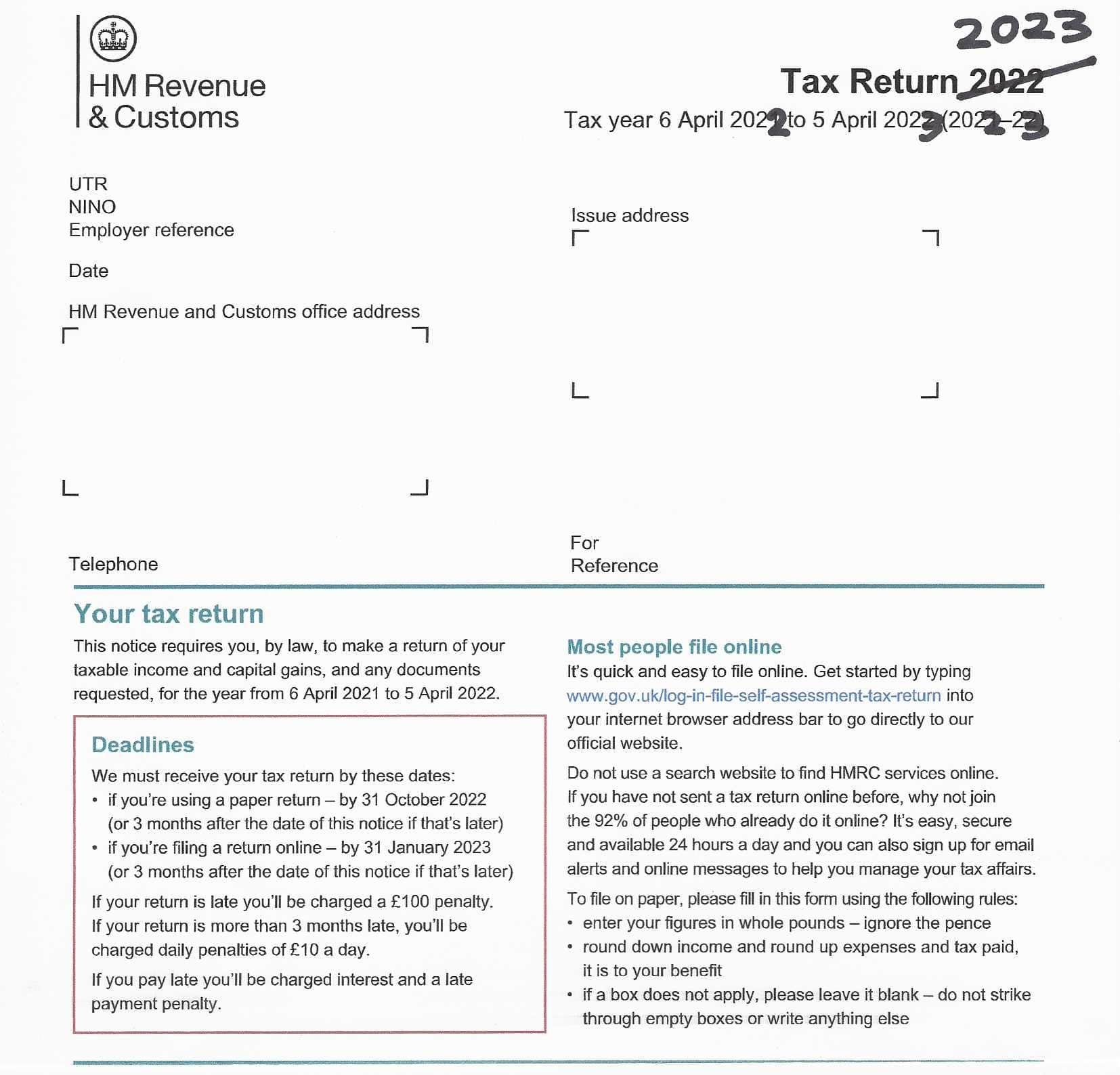

uk-hmrc-tax-documents - Source fakeutilities.com

Question 1: When can I start taking money out of my pension pot?

You can usually start taking money out of your pension from age 55 (rising to age 57 in 2028). However, if you take money out before you reach the age of 55, you may have to pay a tax charge of up to 55%.

Question 2: What is a flexible drawdown?

A flexible drawdown allows you to take money out of your pension pot as and when you need it. However, you must take a minimum amount each year, and if you take out too much, you may have to pay a tax charge.

Question 3: What is an annuity?

An annuity is a guaranteed income for life. When you buy an annuity, you give your pension pot to an insurance company, and they pay you a regular income. Annuities can be a good way to ensure that you have a regular income in retirement, but they can also be expensive, and you may not get back all of the money you put in.

Question 4: What is the lifetime allowance?

The lifetime allowance is the maximum amount of money you can save in your pension pot without paying a tax charge. The current lifetime allowance is £1,073,100.

Question 5: What happens if I take money out of my pension pot and I am still working?

If you take money out of your pension pot while you are still working, you may have to pay Income Tax on the money you take out. You may also have to pay National Insurance contributions if you are under the age of State Pension age.

Question 6: What is the best way to take money out of my pension pot?

The best way to take money out of your pension pot will depend on your individual circumstances. It is important to take professional advice before making any decisions.

It is crucial to understand the tax implications of taking money out of your pension pot before you make any decisions. If you are unsure about anything, do not hesitate to seek professional advice.

Tips To Save Your Pension Pot From Tax

HMRC has put out a caution against taking money out of a pension pot too soon. This is because doing so can incur a hefty tax bill. Here are some tips to help you avoid this:

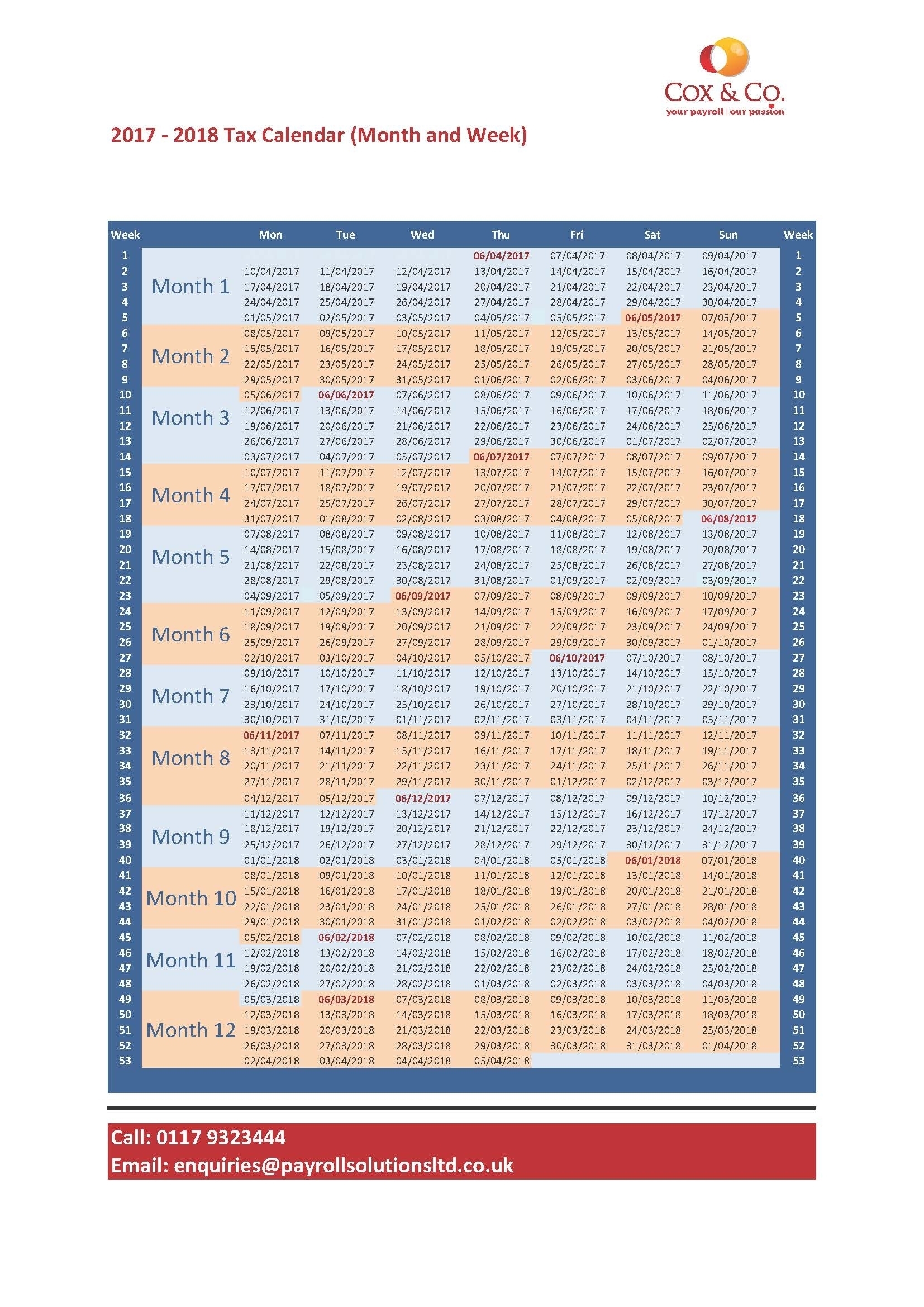

22 Year Tax Calendar Hmrc - Source calendarinspiration.com

Tip 1: Understand the tax rules

The first step is to understand the tax implications of taking money out of your pension pot. Generally, you will be taxed at your marginal income tax rate on any withdrawals. This means that if you are in the higher rate tax bracket, you could end up paying 40% or 45% tax on your withdrawals.

Tip 2: Use tax-free cash

When you reach the age of 55, you can take 25% of your pension pot as a tax-free lump sum. This is a great way to access some of your pension savings without incurring any tax liability. Be aware that any money taken out as a lump sum above the 25% tax-free threshold will be subject to income tax.

Tip 3: Consider phased withdrawals

If you don't need all of your pension savings at once, you can consider taking phased withdrawals. This means taking out a small amount of money each year, which will help you minimize your tax liability. Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early However, you should be aware that if you take out too much money in a short period of time, you could end up paying more tax than you would if you took out a larger lump sum.

Tip 4: Invest your pension savings

Investing your pension savings can help you grow your pot over time. This means that you will have more money to draw on in retirement, which could help you reduce your tax liability.

Tip 5: Seek professional advice

If you are unsure about how to take money out of your pension pot, it is advisable to seek professional advice. A financial advisor can help you understand the tax implications of different withdrawal strategies and make sure that you are making the best decisions for your circumstances.

Conclusion

Following these tips can help you save your pension pot from tax and make the most of your retirement savings.

Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early

Heed HMRC's advice to preserve your pension savings. Premature withdrawals can trigger substantial tax implications and reduce your future financial security. Explore these six key aspects to safeguard your pension pot:

- Taxation: Understand the tax consequences of early withdrawals.

- Investment Growth: Depleting your pot early limits its potential for growth.

- Income Shortfall: Early access may leave you with insufficient income later in life.

- Reduced Tax-Free Lump Sum: Withdrawals reduce the tax-free lump sum available at retirement.

- Missed Pension Contributions: Early withdrawals can interrupt regular pension contributions.

- Financial Planning: Consider the long-term financial implications before accessing your pension early.

Balancing your current needs with securing future financial stability is crucial.

HMRC give Tax Relief pre-approval - Save The Thorold Arms - Source save.thethoroldarms.co.uk

For example, accessing pension funds before age 55 can result in a 25% tax charge, while withdrawals after age 75 may be tax-free. Understanding these tax implications can help you make informed decisions.

Remember, your pension pot is a valuable asset designed to provide financial security in your later years. By carefully considering the key aspects outlined above, you can minimize the impact of tax and maximize your future financial well-being.

HMRC Tax Overview | Online self, Document templates, Documents - Source www.pinterest.co.uk

Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early

The connection between "Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early" is crucial because it highlights the potential tax implications of withdrawing money from a pension pot before reaching the minimum age of 55. If an individual takes out money before this age, they could face a hefty tax bill of up to 55%. This is because the government considers early withdrawals as income and subjects them to income tax. Understanding this connection is essential for individuals to make informed decisions about their pension savings and avoid costly tax penalties.

Tax Calculator 2023 2024 Hmrc - Image to u - Source imagetou.com

The importance of this topic lies in its potential financial impact on individuals. Taking money out of a pension pot too early can significantly reduce its value, impacting long-term financial security. By raising awareness of the tax implications, the HMRC aims to encourage individuals to preserve their pension savings for retirement when they need them most. It also underscores the need for financial planning and seeking professional advice to make informed decisions about pension withdrawals.

For example, if an individual has a pension pot worth £100,000 and withdraws £20,000 before the age of 55, they could face a tax bill of up to £11,000. This would reduce their pension pot to £89,000, which could have a significant impact on their retirement income. Therefore, understanding the connection between early pension withdrawals and tax implications is crucial for individuals to make informed decisions and safeguard their financial future.

Table: Key Points on Tax Implications of Early Pension Withdrawals

| Key Point | Explanation |

|---|---|

| Minimum Age for Withdrawal | 55 |

| Tax Penalty for Early Withdrawal | Up to 55% |

| Calculation of Tax Penalty | Income tax applied to the amount withdrawn |

| Impact on Pension Pot | Reduces the value of the pot, affecting long-term financial security |

| Significance | Highlights the importance of preserving pension savings for retirement |

Conclusion

In conclusion, the connection between "Save Your Pension Pot From Tax: HMRC Warning On Taking Money Too Early" underscores the crucial need for individuals to be aware of the tax implications of withdrawing money from their pension pots before reaching the minimum age of 55. Understanding this connection empowers individuals to make informed decisions about their pension savings and avoid costly tax penalties that could jeopardize their financial security in retirement. It also emphasizes the significance of seeking professional financial advice to navigate the complexities of pension withdrawals and optimize retirement planning.

By raising awareness of this topic, the HMRC aims to protect individuals from financial pitfalls and encourage responsible management of pension savings. Embracing a proactive and informed approach towards pension withdrawals can help individuals safeguard their financial well-being and secure a comfortable retirement.