Want to attain convenient and quick cash loans in the UAE? This comprehensive guide to "UAE Salary Advance: Unbanked Individuals' Guide To Fast, Secure Cash Loans" is specifically designed for unbanked individuals in the region.

Unbanked individuals in the UAE often face hurdles in obtaining financial services, including access to traditional bank loans. To address this challenge, a growing number of financial institutions and fintech companies are offering salary advance services tailored to meet the specific needs of this population. Our team analyzed various options, dug deep into the details, and compiled this "UAE Salary Advance: Unbanked Individuals' Guide To Fast, Secure Cash Loans" to empower you with the knowledge to make informed decisions.

| Criteria | Salary Advance | Traditional Loan |

|---|---|---|

| Eligibility | Unbanked individuals with regular income | Banked individuals with stable income and credit history |

| Loan Amount | Typically a portion of the borrower's salary | Varies based on factors such as income, credit score, and loan term |

| Repayment | Deducted from the borrower's salary | Monthly installments over a predetermined loan term |

| Interest Rates | May vary depending on the lender and borrower's profile | Typically fixed or variable interest rates based on the borrower's creditworthiness |

| Processing Time | Fast and convenient, often approved within a few hours | Can take several days or weeks for approval |

In this guide, we will delve into the specifics of salary advance services in the UAE, including eligibility criteria, application process, repayment terms, and key considerations for unbanked individuals.

FAQ

This FAQ section provides comprehensive answers to frequently asked questions about salary advances for unbanked individuals in the UAE, empowering you to make informed decisions about securing fast and secure cash loans.

Question 1: Is a salary advance right for me?

A salary advance can be a suitable option if you need immediate cash to cover unexpected expenses or emergencies. It allows you to access a portion of your future salary without having to wait for payday.

Question 2: What are the eligibility criteria for a salary advance?

Typically, you must be employed with a steady income and have a valid UAE residency visa to qualify for a salary advance.

Question 3: How quickly can I get a salary advance?

The application process for a salary advance is streamlined, and you can often receive the funds within 24 hours or less after approval.

Question 4: Are there any hidden fees or charges?

Reputable lenders disclose all fees and charges upfront, ensuring transparency and avoiding any unexpected costs.

Question 5: How does a salary advance impact my credit score?

Salary advances do not typically affect your credit score, as they are not reported to credit bureaus.

Question 6: What are some tips for choosing a reliable salary advance provider?

Consider factors such as the lender's reputation, interest rates, fees, and customer service to identify a trusted provider that meets your needs.

In conclusion, accessing cash through salary advances can provide financial relief when facing unforeseen circumstances. By understanding the key aspects and frequently asked questions, you can make informed decisions about securing a salary advance, ensuring a hassle-free and secure experience.

Tips

To ensure a smooth and secure salary advance experience, follow these essential tips:

Tip 1: Verify the Lender's Credibility

Before applying for a salary advance, meticulously research the lender's reputation, reviews, and licensing status. This due diligence will safeguard you from fraudulent or unethical lenders.

Tip 2: Understand the Repayment Terms

Thoroughly review the repayment schedule, interest rates, and any additional fees associated with the salary advance. Ensure that you can comfortably meet the repayment obligations without incurring undue financial strain.

Tip 3: Explore Alternative Lenders

Don't limit yourself to traditional banks; consider alternative lenders that cater to unbanked individuals. These lenders may offer more flexible repayment options and reduced documentation requirements.

Tip 4: Provide Accurate Information

When applying for a salary advance, provide accurate and verifiable information. This includes your employment details, income, and any outstanding debts. Transparent and honest disclosure will enhance your application's credibility.

Tip 5: Seek Professional Advice if Needed

If you encounter any difficulties understanding the terms or repayment obligations of a salary advance, do not hesitate to seek professional financial advice. A qualified advisor can provide clarity and guide you towards the most suitable option.

By adhering to these tips, unbanked individuals can access fast, secure, and reliable cash loans through salary advances. For more comprehensive guidance, refer to UAE Salary Advance: Unbanked Individuals' Guide To Fast, Secure Cash Loans.

UAE Salary Advance: Unbanked Individuals' Guide To Fast, Secure Cash Loans

Access to fast, secure salary advances is crucial for unbanked individuals in the UAE, enabling them to address unforeseen financial needs and emergencies. Six key aspects are essential to consider to understand these salary advance options:

- Eligibility Requirements: Determine who qualifies for salary advances based on income, employment, and residency criteria.

- Lending Process: Understand the application process, documentation required, and approval timelines.

- Loan Terms: Review the loan amount, repayment schedule, interest rates, and any additional fees.

- Repayment Options: Explore flexible repayment options that align with individual circumstances, including automatic deductions or post-dated checks.

- Transparency and Security: Verify the lender's reputation, licensing, and data security measures to ensure a safe and reliable experience.

- Customer Support: Access to dedicated support channels for inquiries, loan management, and dispute resolution.

Business Loans 101: Merchant Cash Advance vs. Other Business Loans - Source dealstruck.com

These aspects provide a comprehensive framework to guide unbanked individuals in the UAE towards finding suitable salary advance solutions that meet their financial needs while prioritizing security and convenience.

UAE Salary Advance: Unbanked Individuals' Guide To Fast, Secure Cash Loans

In the United Arab Emirates (UAE), a significant number of individuals remain unbanked, lacking access to traditional financial services. This can pose challenges when facing unexpected expenses or financial emergencies. Salary advances have emerged as a solution for these unbanked individuals, offering fast and secure cash loans.

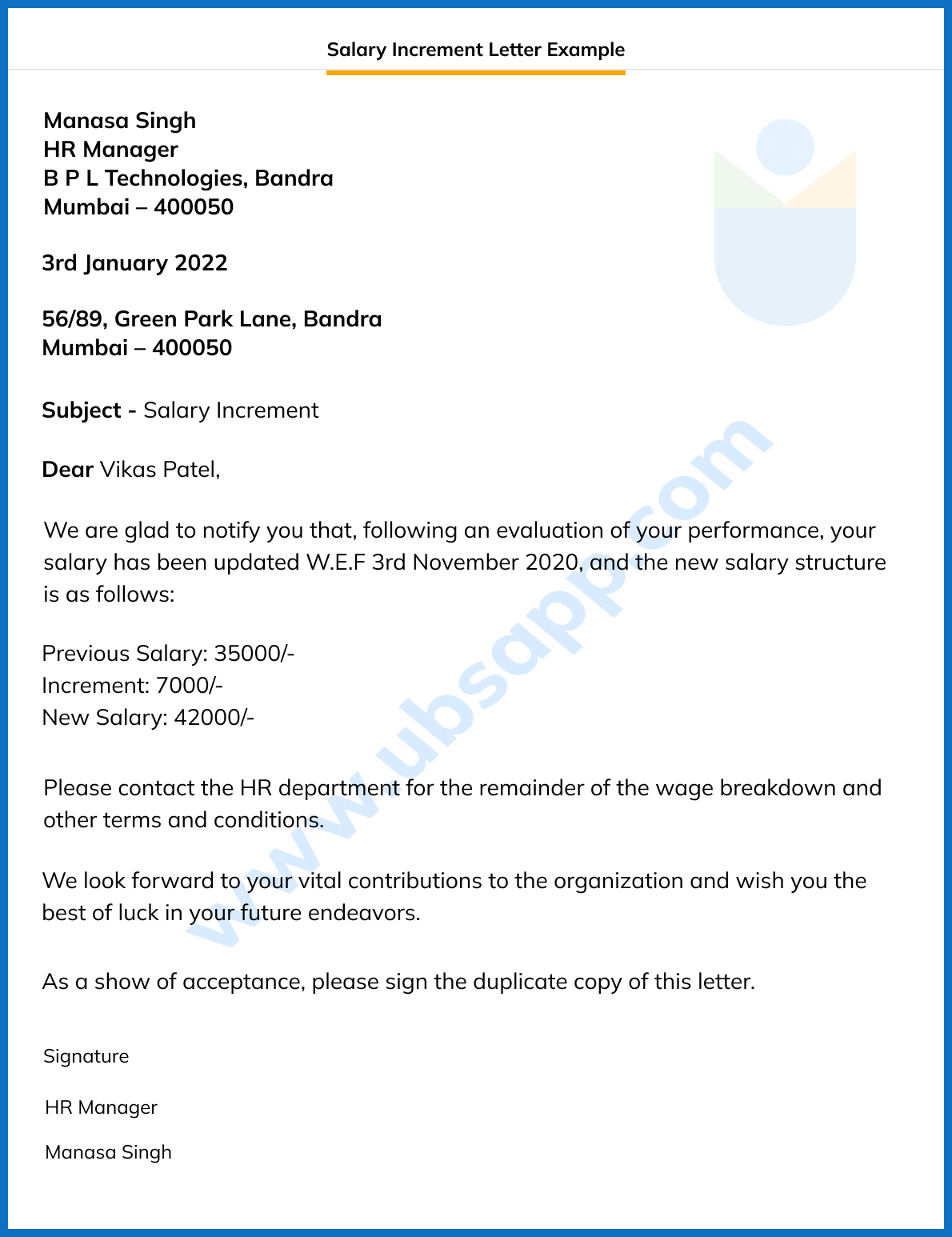

Salary Increment Letter Format Uae Government - Infoupdate.org - Source infoupdate.org

The connection between salary advances and the target audience of unbanked individuals is crucial. For those without bank accounts or credit histories, salary advances provide an alternative source of financing. These loans are typically based on an individual's salary and employment history, making them accessible even to those with limited financial records.

The practical significance of understanding this connection lies in its ability to empower unbanked individuals in the UAE. By providing access to fast and secure cash loans, salary advances can alleviate financial burdens, cover unexpected expenses, and promote financial stability. This can have a positive impact on individuals' well-being and overall economic participation.

Eligibility Criteria for Salary Advances in the UAE

| Criteria | Requirement |

|---|---|

| Employment | Employed by a UAE-based company |

| Salary | Minimum monthly salary as per lender's criteria |

| Residence | Valid UAE residency permit |

| Credit History | No negative credit history or outstanding debts |

| Income Proof | Recent salary slips or bank statements |