Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings - The key to a financially secure retirement lies in smart planning and maximizing your benefits. Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings provides invaluable insights into making the most of your retirement savings with Emekli Promosyon.

Editor's Note: Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings is published today to empower individuals with the knowledge and strategies to optimize their retirement savings and enjoy a comfortable and financially secure future.

Through extensive analysis and thorough research, our team has meticulously compiled this guide to demystify Emekli Promosyon and help you navigate its complexities. This comprehensive resource empowers individuals to make informed decisions, maximize their retirement savings, and unlock exceptional benefits for a secure financial future.

Key Differences Table:

Transition to Main Article Topics:

FAQ

This comprehensive FAQs section aims to provide clarity on the intricacies of the Emekli Promosyon system, helping you make informed decisions and maximize your retirement benefits.

Question 1: What is Emekli Promosyon?

Emekli Promosyon is a one-time monetary payment offered to individuals retiring from Social Security in Turkey. It aims to provide financial support during the transition into retirement.

Question 2: Who is eligible for Emekli Promosyon?

All individuals who have made sufficient Social Security contributions and meet the minimum retirement age requirements are eligible for Emekli Promosyon. The specific eligibility criteria may vary depending on the individual's situation.

Question 3: How much is the Emekli Promosyon payment?

The amount of the Emekli Promosyon payment is determined by the number of years the individual has worked and made Social Security contributions. The payment can range from a few thousand to tens of thousands of Turkish Lira.

Question 4: When is the Emekli Promosyon payment made?

The Emekli Promosyon payment is typically made within a few months after the individual retires and starts receiving their pension. The exact timing may vary depending on the specific circumstances.

Question 5: Can the Emekli Promosyon payment be withdrawn early?

In general, the Emekli Promosyon payment cannot be withdrawn early. It is intended as a one-time financial assistance to support the transition into retirement and must be used wisely.

Question 6: What are the tax implications of the Emekli Promosyon payment?

The Emekli Promosyon payment is subject to income tax. The specific tax rate will depend on the individual's overall income and tax bracket.

By understanding these key points, individuals approaching retirement can make informed decisions about their Emekli Promosyon and maximize the potential benefits it offers.

For more detailed information and guidance, refer to the comprehensive Emekli Promosyon Guide.

Tips

Unlocking exceptional retirement benefits from Emekli Promosyon is vital for maximizing financial security during retirement years. This guide provides essential tips to help individuals optimize their Emekli Promosyon savings.

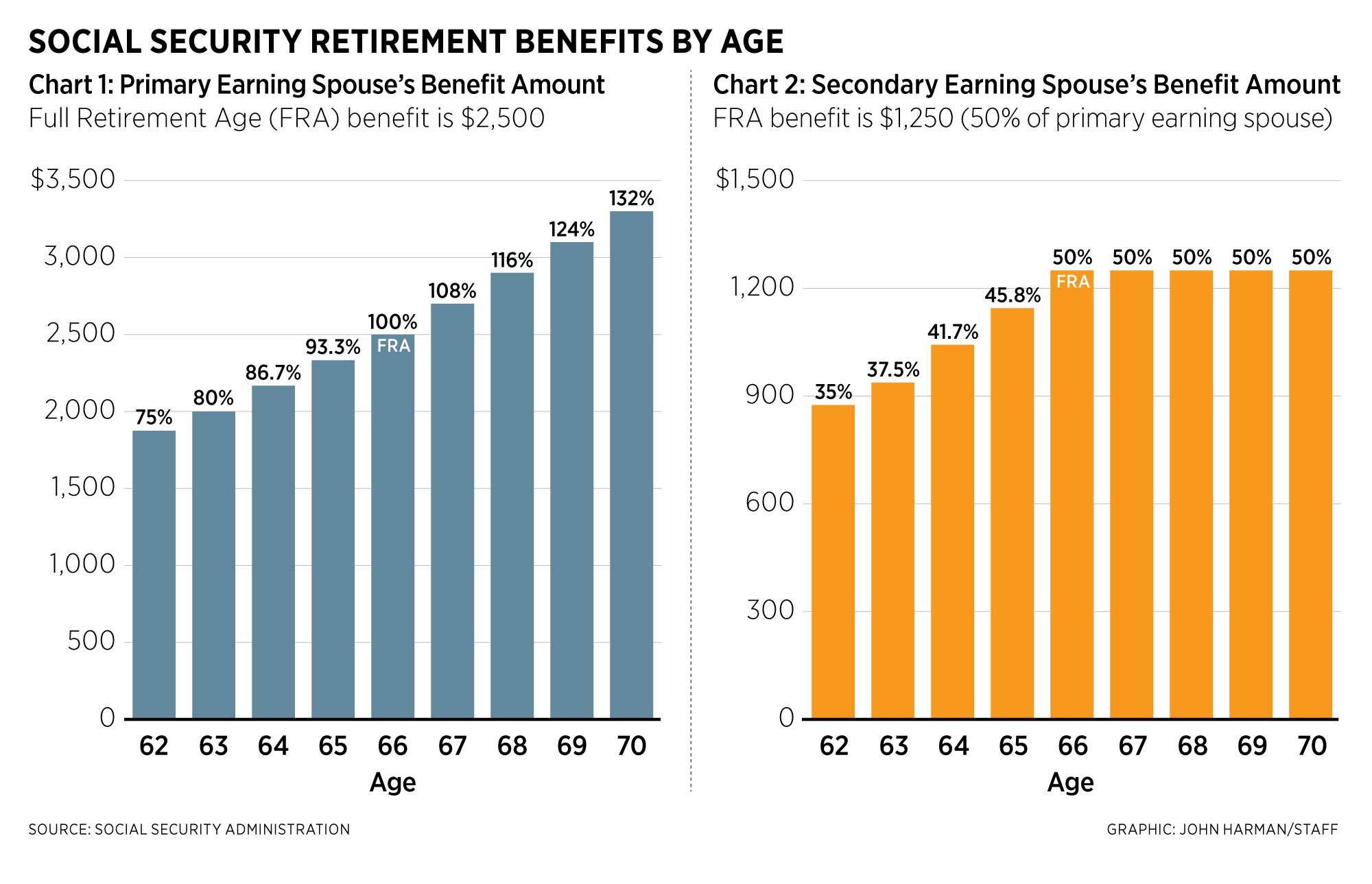

MOAA - When It Comes to Social Security Retirement Benefits, Timing Matters - Source www.moaa.org

Tip 1: Understand Retirement Savings:

Familiarize with different retirement savings options and choose the one that aligns with personal financial goals and risk tolerance. Emekli Promosyon can be invested in various retirement accounts, such as retirement mutual funds or individual retirement accounts (IRAs), each with unique features and benefits.

Tip 2: Maximize Contributions:

Contribute as much as possible to Emekli Promosyon to maximize retirement savings. Consider increasing contributions gradually over time to adjust to changes in income and lifestyle. Utilize any available tax-advantaged options to reduce the current tax burden while enhancing retirement savings.

Tip 3: Choose Wise Investments:

Select investments based on personal risk tolerance and retirement goals. Consider diversifying investments across different asset classes and investment styles to manage risks and maximize returns. Regularly review investments and make adjustments as needed to align with evolving financial circumstances.

Tip 4: Take Advantage of Tax Breaks:

Utilize tax-deferred and tax-free accounts to minimize current tax obligations while increasing retirement savings. Emekli Promosyon contributions may be tax-deductible, reducing the taxable income and potentially increasing tax refunds. Earnings within tax-deferred accounts accumulate tax-free until withdrawn during retirement.

Tip 5: Plan for Long-Term Growth:

Start saving for retirement as early as possible to take advantage of the power of compound interest. Even small contributions at a young age can accumulate significantly over time through the compounding effect. Regular contributions and prudent investments contribute to steady growth and enhanced retirement savings.

Tip 6: Seek Professional Guidance:

Consult with financial professionals for personalized advice and guidance on Emekli Promosyon and other retirement planning strategies. Financial advisors can assist in creating a customized retirement savings plan, optimize investment choices, and provide ongoing support to navigate financial challenges and maximize outcomes.

Tip 7: Stay Informed and Monitor Progress:

Keep up-to-date with relevant financial news and regulations regarding Emekli Promosyon and retirement savings. Regularly track retirement account balances, investment performance, and overall financial progress. Make necessary adjustments to the retirement savings strategy based on changes in financial conditions, market trends, and personal circumstances.

Unlocking exceptional retirement benefits requires a strategic approach and prudent financial planning. By following these tips, individuals can optimize their Emekli Promosyon savings, maximize retirement contributions, and achieve long-term financial security during their golden years. Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings

Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings

Retirement, a significant life stage, necessitates meticulous planning. Emekli Promosyon, a crucial component of this planning, provides exceptional benefits that can enhance financial security and well-being during this transition. This guide delves into six key aspects to help individuals maximize their Emekli Promosyon savings.

- Understand Eligibility: Ensuring eligibility based on age, contribution history, and tenure.

- Compare Institutions: Evaluating different banks and institutions based on interest rates, fees, and terms.

- Negotiate Terms: Engaging in negotiations with institutions to secure preferable agreements.

- Consider Tax Implications: Understanding the tax implications associated with Emekli Promosyon withdrawal or lump-sum payments.

- Diversify Investments: Allocating Emekli Promosyon funds across various investment options to mitigate risk and optimize returns.

- Seek Financial Advice: Consulting with qualified financial advisors for personalized guidance and expert insights.

Pre-Retirement: Are We There Yet? - United Benefits - Source unitedbenefits.com

These aspects are interconnected and play a crucial role in maximizing Emekli Promosyon benefits. For instance, understanding eligibility ensures that individuals receive the full extent of their entitled funds. Comparing institutions helps them identify the most advantageous offers and secure higher interest rates. Diversify investments mitigates risk and enhances the potential for long-term growth. Seeking financial advice provides tailored recommendations and helps individuals make informed decisions that align with their financial goals and circumstances.

Unlock Exceptional Retirement Benefits: Emekli Promosyon Guide For Maximum Savings

The Emekli Promosyon, a promotional campaign offered by banks in Turkey, provides significant financial benefits to retirees who transfer their pensions to these institutions. This guide aims to empower retirees with the knowledge and strategies to maximize their savings through the Emekli Promosyon.

Unlock the Secret to Exceptional Oral Health: The Miraculous Benefits - Source dailydetoxhacks.com

Understanding the Emekli Promosyon is crucial for retirees seeking to secure their financial future. By providing clear and comprehensive information, this guide enables retirees to make informed decisions about their pension transfer, ensuring maximum savings and long-term financial stability.

The practical significance of this understanding lies in its potential to enhance retirees' quality of life. By maximizing their Emekli Promosyon benefits, retirees can supplement their pension income, reduce financial burdens, and enjoy a more comfortable retirement.

The Importance of Emekli Promosyon for Retirees

The Emekli Promosyon offers several valuable benefits for retirees in Turkey:

| Benefit | Details |

| Cash Payment | Retirees receive a lump sum payment upon transferring their pension to a participating bank. |

| Interest Rates | Banks offer competitive interest rates on the deposited pension funds, providing retirees with additional income. |

| Bonus Gifts | Some banks offer bonus gifts, such as appliances or travel vouchers, to attract new retirees. |

| Discounted Services | Retirees may be eligible for discounted banking services, such as lower loan interest rates or free account maintenance. |

Choosing the Right Bank

To maximize their Emekli Promosyon benefits, retirees should carefully consider the following factors when choosing a bank:

| Factor | Considerations |

| Cash Payment Amount | Banks offer varying cash payment amounts, so compare them to choose the highest offer. |

| Interest Rates | Consider the interest rates offered on deposited funds to maximize potential income. |

| Bonus Gifts | Evaluate the value and relevance of any bonus gifts offered by the banks. |

| Discounted Services | Assess the potential savings on banking services, such as loan interest rates and account fees. |

| Reputation and Financial Stability | Choose a bank with a strong reputation and financial stability to ensure the security of your pension funds. |

Conclusion

The Emekli Promosyon presents a valuable opportunity for retirees in Turkey to enhance their financial well-being during and beyond their retirement years. By maximizing their Emekli Promosyon benefits, retirees can secure additional income, reduce expenses, and enjoy a more comfortable and financially secure retirement.

This guide has equipped retirees with the knowledge and strategies to make informed decisions about their pension transfer, unlocking the full potential of the Emekli Promosyon. By empowering retirees to maximize their savings, this guide contributes to a more financially secure and fulfilling retirement for all.