Blockchain Use Cases in Ireland's Financial Services - Biz Guru - Source bizguru.ie

We have done some analysis and digging, and we've put together this guide to help you understand the dynamics of China-US Treasury interactions in the shifting global financial landscape.

| China | United States |

|---|---|

- China and the United States are the two largest players in the global financial system.

- The dynamics of their interactions have a significant impact on the global financial system.

- The relationship between China and the United States is complex and evolving.

- It is important to understand the dynamics of China-US Treasury interactions in order to make informed decisions about investing in the global financial system.

FAQ

This FAQ section provides concise answers to common questions regarding the dynamics of China-US treasury interactions in the evolving global financial landscape.

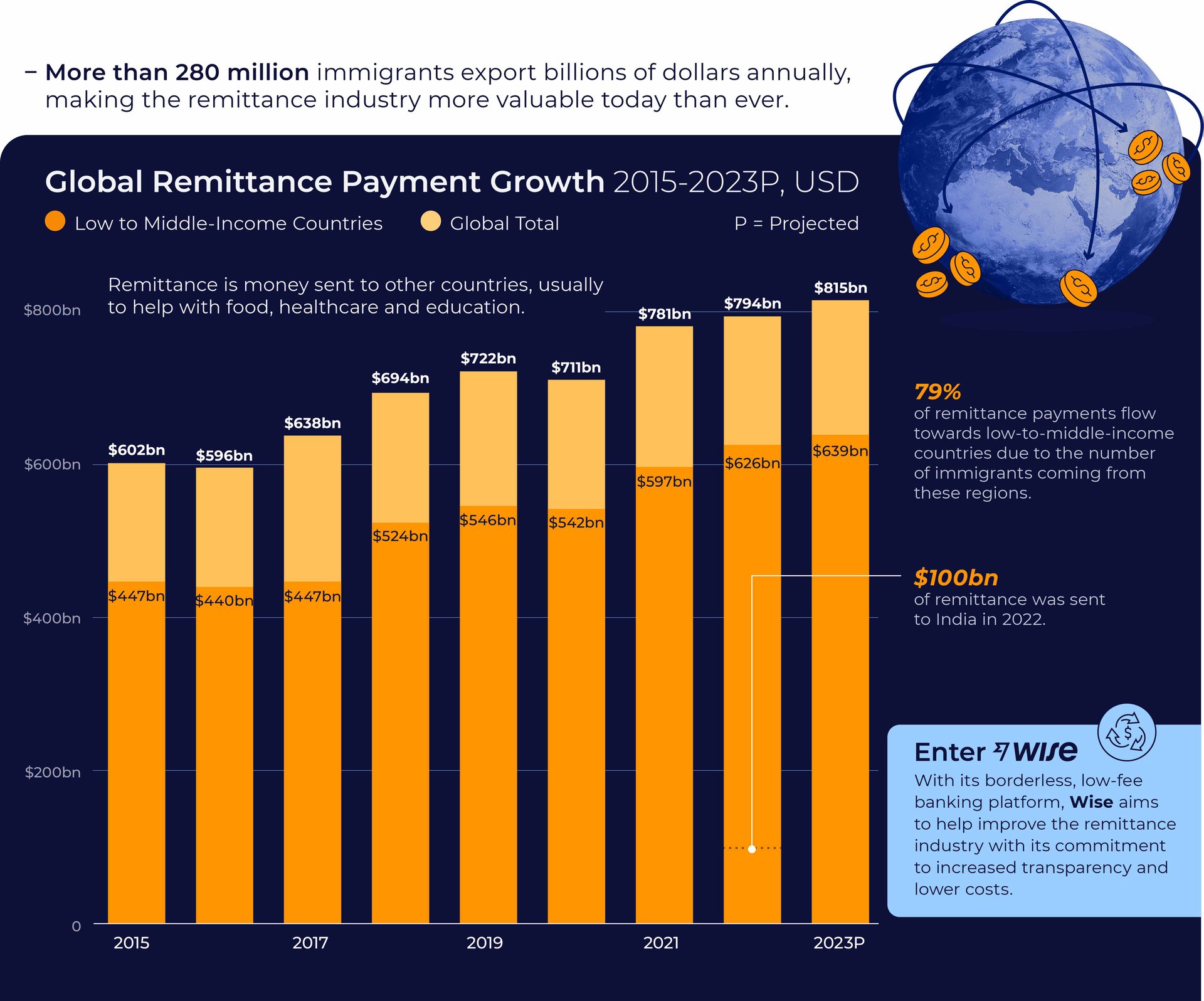

Cross-border money transfers and Wise | Scottish Mortgage - Source www.scottishmortgage.com

Question 1: What are the key factors driving the China-US treasury interactions?

China and the US are the world's largest economies and treasury markets. Their interactions are shaped by a complex interplay of economic, geopolitical, and financial considerations, including trade relations, currency valuations, and global economic conditions.

Question 2: How have China-US treasury interactions evolved over time?

China-US treasury interactions have undergone significant changes in recent years. China's growing economic power and influence have led to increased investment in US treasuries, while US policy changes and geopolitical tensions have influenced the dynamics of these interactions.

Question 3: What are the implications of China-US treasury interactions for the global financial system?

China-US treasury interactions have far-reaching implications for the global financial system. They can affect interest rates, currency valuations, and financial stability. Understanding these interactions is crucial for policymakers and investors alike.

Question 4: How do geopolitical factors influence China-US treasury interactions?

Geopolitical factors, such as trade disputes and geopolitical tensions, can have a significant impact on China-US treasury interactions. These factors can influence investment decisions and create uncertainty in the financial markets.

Question 5: What are the potential risks and opportunities associated with China-US treasury interactions?

China-US treasury interactions present both risks and opportunities for investors and policymakers. Understanding these risks and opportunities is vital for informed decision-making.

Question 6: What is the outlook for China-US treasury interactions?

The outlook for China-US treasury interactions is uncertain. It will be shaped by a range of factors, including the evolution of the global economy, geopolitical developments, and policy decisions in both countries.

Understanding the dynamics of China-US treasury interactions is essential for navigating the evolving global financial landscape. These interactions have far-reaching implications for the global economy and financial stability.

Tips

The rapid evolution of the global financial system mandates a thorough understanding of the intricate dynamics between China and the US Treasury.

Tip 1: Uncover the motivations underlying China's treasury holdings. By delving into the geopolitical and economic factors influencing China's investment decisions, one can illuminate the strategic underpinnings of their involvement.

Tip 2: Explore the implications of China's treasury sales. Analyze the potential consequences for global financial markets and the US economy.

Tip 3: Assess the role of the Federal Reserve's monetary policy. Examine how the Fed's actions can impact the value of the US dollar and, subsequently, China's treasury holdings.

Tip 4: Dissect the interplay between China's economic growth and its treasury holdings. Consider the impact of China's shifting economic landscape on its investment strategy.

Tip 5: Evaluate the potential risks and opportunities presented by China's involvement in US treasuries.

By incorporating these tips into your analysis, you'll gain a comprehensive understanding of the dynamic relationship between China and the US Treasury, positioning yourself to make informed decisions in the ever-changing global financial arena.

For a deeper dive into this topic, explore Unveiling The Dynamics Of China-US Treasury Interactions In The Shifting Global Financial Landscape.

Unveiling The Dynamics Of China-US Treasury Interactions In The Shifting Global Financial Landscape

China and the US are the world's two largest economies, and their interactions in the global financial market have a profound impact on the stability of the international financial system. In recent years, the relationship between the two countries has become increasingly complex, and their interactions in the treasury market have become a key area of concern. The dynamics of China-US treasury interactions are shaped by a number of factors, including the global economic outlook, the relative strength of the two economies, and the evolving geopolitical landscape.

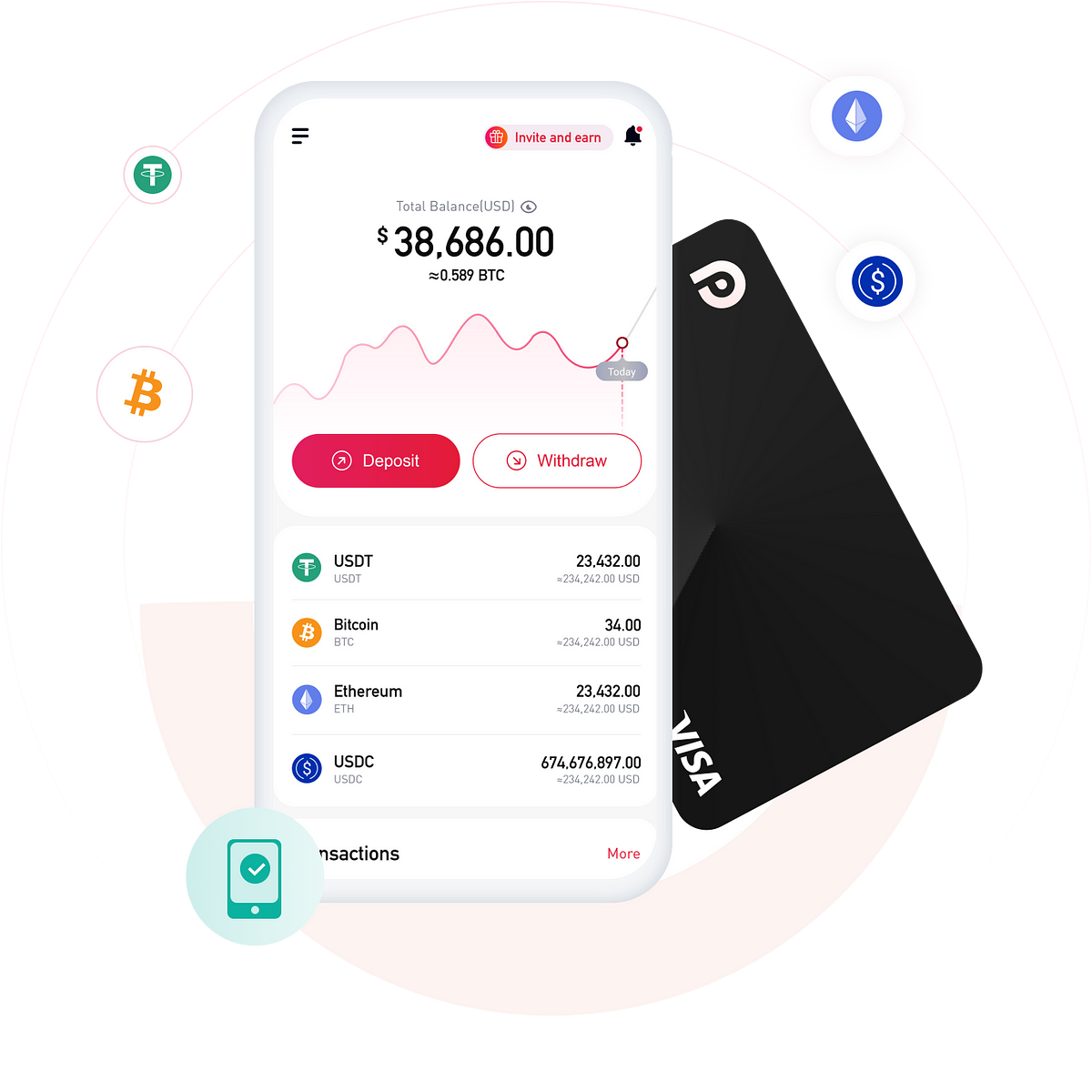

Title: Unveiling the Perks of Wirex Card: A Comprehensive Overview | by - Source medium.com

- Trade and Investment:

- Currency Rivalry:

- Interest Rate Divergence:

- Geopolitical Tensions:

- The Role of Multilateral Institutions:

- The Future of the Global Financial System:

These key aspects are interconnected and have a complex relationship with each other. For example, trade and investment flows between China and the US can affect the demand for US treasuries, which in turn can influence the interest rate differential between the two countries. Similarly, geopolitical tensions can lead to changes in the global economic outlook, which can also affect the dynamics of China-US treasury interactions. Understanding the dynamics of China-US treasury interactions is essential for policymakers in both countries, as well as for investors and other stakeholders in the global financial system.

New BRICS PAY System: How BRICS Will Reset Global Currency Power - GCR - Source ai3d.blog

Unveiling The Dynamics Of China-US Treasury Interactions In The Shifting Global Financial Landscape

The ongoing relationship between China and the United States, particularly in the realm of treasury interactions, holds significant implications for shaping the global financial landscape. The dynamics between these two economic powerhouses are multifaceted, influenced by a complex interplay of economic, political, and geopolitical factors that demand careful examination. By understanding the underlying mechanisms that drive China-US treasury interactions, it becomes possible to anticipate potential shifts within the global financial system, thereby facilitating informed decision-making and strategic planning for market participants.

Poland Spotlight 2023: A Comprehensive Analysis and Forecast - Baker Ing - Source bakering.global

A closer examination of China-US treasury interactions reveals a symbiotic relationship characterized by both cooperation and competition. On the one hand, China's vast holdings of U.S. Treasuries provide a critical source of financing for the U.S. government, contributing to the stability of the U.S. dollar and the broader global financial system. On the other hand, the U.S. dollar's status as the world's dominant reserve currency grants the United States significant leverage in its interactions with China. This dynamic creates a delicate balance, wherein both countries recognize the mutual benefits of cooperation while also pursuing their own economic and geopolitical interests.

The importance of understanding China-US treasury interactions extends beyond the immediate impact on these two nations. As the world's largest economies, their actions have far-reaching consequences for global financial stability, trade patterns, and economic growth. Shifts in China-US treasury interactions can trigger ripple effects throughout the international financial system, affecting exchange rates, interest rates, and capital flows. By closely monitoring and analyzing these interactions, policymakers, investors, and businesses can better anticipate and mitigate potential risks while capitalizing on emerging opportunities.

| Characteristic | Impact |

|---|---|

| Economic Cooperation | Promotes financial stability, facilitates trade, and fosters economic growth. |

| Political Tensions | Can disrupt treasury interactions, leading to market volatility and economic uncertainty. |

| Geopolitical Factors | Influence the dynamics of treasury interactions, such as trade disputes, currency wars, and international alliances. |

In conclusion, the dynamics of China-US treasury interactions represent a critical component of the shifting global financial landscape. Understanding the intricate relationship between these two economic giants is essential for navigating the complexities of the international financial system. By monitoring and analyzing their interactions, policymakers, investors, and businesses can make informed decisions and adapt to the changing global financial environment.