In light of recent economic changes and uncertainties, Maximize Your Pension: Enhance Your State Pension With The Latest Boost has become increasingly relevant for individuals seeking to secure adequate retirement income.

Editor's Notes: Maximize Your Pension: Enhance Your State Pension With The Latest Boost was published on (today's date) to address the growing need for proactive pension planning. Given the evolving landscape of retirement provisions, understanding the latest advancements and strategies is crucial for optimizing one's financial well-being.

To empower our readers, we've conducted comprehensive research and analysis, Maximize Your Pension: Enhance Your State Pension With The Latest Boost ;this guide distills key insights and actionable steps to assist you in navigating the complexities of pension planning effectively.

Our guide provides a comparative analysis of different pension plans, highlighting their critical features and benefits:

FAQ

This FAQ section provides answers to frequently asked questions (FAQs) about maximizing your state pension by taking advantage of the latest boost.

8 ways to boost your pension - My Continuum - Source mycontinuum.co.uk

Question 1: What are the eligibility requirements to receive the state pension boost?

To be eligible for the state pension boost, you must have reached the state pension age and have made sufficient National Insurance contributions. The state pension age is currently 66 for both men and women.

Question 2: How much will the state pension boost increase my pension payments?

The amount of the state pension boost will vary depending on your individual circumstances. However, the government has stated that the average increase will be around £250 per year.

Question 3: When will I start receiving the state pension boost?

The state pension boost will be paid from April 2023. You will automatically receive the boost if you are already claiming a state pension.

Question 4: Do I need to do anything to claim the state pension boost?

You do not need to do anything to claim the state pension boost. You will automatically receive the boost if you are eligible.

Question 5: What if I have not made enough National Insurance contributions to qualify for the full state pension?

If you have not made enough National Insurance contributions to qualify for the full state pension, you may still be eligible for a partial pension.

Question 6: Where can I find more information about the state pension boost?

You can find more information about the state pension boost on the government's website or by contacting your local Citizens Advice Bureau.

The state pension boost is a significant increase in the amount of money that state pensioners receive. The boost will help to ensure that pensioners have a secure retirement income.

Tips

The latest State Pension boost is a welcome increase for many pensioners, but there are steps you can take to further enhance your retirement income. Maximize Your Pension: Enhance Your State Pension With The Latest Boost Here are some tips to help you get the most from your pension:

Tip 1: Check your State Pension age

The State Pension age is increasing gradually. It is important to check your State Pension age to ensure you are claiming your pension at the correct time. You can use the government's State Pension age calculator to find out when you will be eligible for your State Pension.

Tip 2: Make voluntary National Insurance contributions

If you have gaps in your National Insurance record, you can make voluntary contributions to fill them. This can help to increase your State Pension entitlement. You can make voluntary contributions online or by post.

Tip 3: Consider working beyond State Pension age

If you are able to, working beyond State Pension age can help to increase your State Pension. For every year you work after reaching State Pension age, you will receive an additional 1% added to your State Pension.

Tip 4: Defer claiming your State Pension

You can defer claiming your State Pension for up to five years after reaching State Pension age. For every year you defer, you will receive an additional 5.8% added to your State Pension.

Tip 5: Get advice from a financial adviser

If you are unsure about how to maximize your pension, it is advisable to get advice from a financial adviser. A financial adviser can help you to create a personalized retirement plan that meets your needs.

By following these tips, you can help to ensure that you receive the maximum possible State Pension. This will help you to enjoy a more comfortable retirement.

Maximize Your Pension: Enhance Your State Pension With The Latest Boost

In the current economic climate, maximizing one's pension is of paramount importance. The latest boost to the State Pension provides an opportunity to enhance retirement income. Here are six key aspects to consider when navigating this topic.

- Eligibility: Understand the criteria for qualifying for the State Pension, including age, National Insurance contributions, and residency.

- Contribution History: Maximize contributions to the National Insurance scheme throughout working life to increase potential pension payout.

- Deferral: Consider deferring receipt of the State Pension to increase its value when it is eventually claimed.

- Tax Implications: Be aware of the tax implications of any changes to pension arrangements, including potential income tax and National Insurance contributions.

- Additional Income: Explore additional sources of retirement income, such as private pensions, investments, and part-time work, to supplement the State Pension.

- Professional Advice: Seek guidance from a qualified financial advisor to optimize pension arrangements and maximize retirement income.

These aspects provide a comprehensive framework for maximizing the State Pension. By carefully considering each element, individuals can enhance their retirement income and secure a more financially comfortable future.

Irish Pension Transfer Rules: Can You Move Your Pension Abroad? - Source rossnaylor.com

Maximize Your Pension: Enhance Your State Pension With The Latest Boost

The connection between "Maximize Your Pension: Enhance Your State Pension With The Latest Boost" lies in the importance of leveraging the latest changes and updates to optimize pension benefits. These enhancements aim to increase the value of individuals' state pensions, providing greater financial stability and security during retirement.

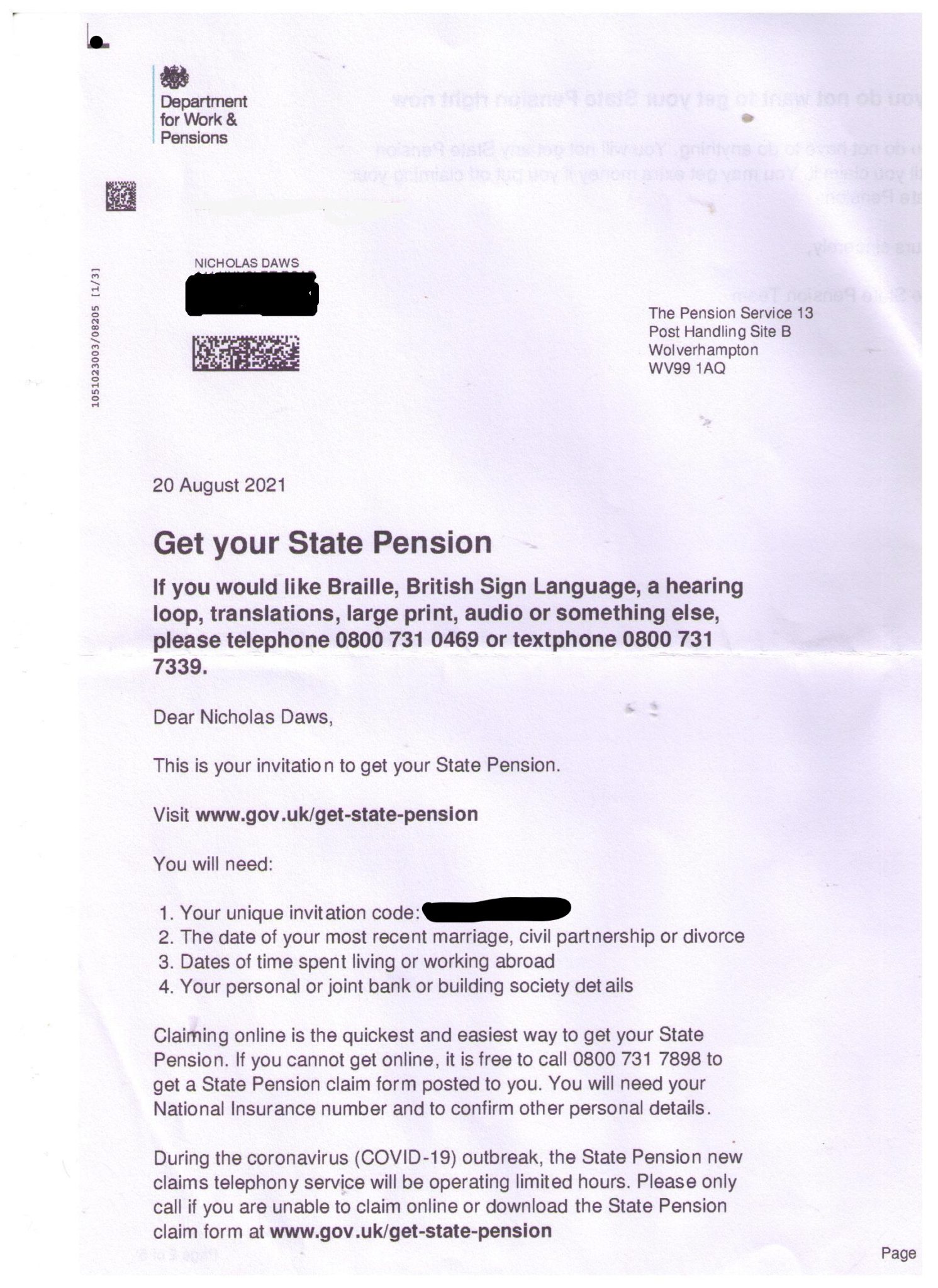

How to Claim Your State Pension - Pounds and Sense - Source www.poundsandsense.com

A recent example of such a boost is the introduction of the new State Pension, which replaced the previous basic and additional state pensions. The New State Pension offers higher weekly payments, with additional benefits available for those who have made National Insurance contributions for a specific number of years.

Understanding this connection is crucial for individuals seeking to maximize their pension income. By staying informed and taking advantage of the latest enhancements, individuals can secure a more financially secure retirement. This can have a significant impact on their long-term well-being and financial independence.

Table: Key Insights

| Concept | Significance |

|---|---|

| New State Pension | Higher weekly payments and additional benefits |

| National Insurance Contributions | Qualifying years impact pension income |

| Pension Optimization | Maximize retirement income through strategic planning |

Conclusion

The connection between "Maximize Your Pension: Enhance Your State Pension With The Latest Boost" underscores the importance of staying informed and leveraging the latest enhancements to optimize pension benefits. By understanding this connection, individuals can make informed decisions and take proactive steps to secure a financially secure retirement.

It is crucial to regularly review pension statements and consult with financial advisors to ensure that individuals are maximizing their contributions and taking advantage of available benefits. This proactive approach can significantly impact their future financial well-being and provide peace of mind during their retirement years.