UK Car Tax Increase 2025: Brace for a Significant Impact on Drivers

Editor's Note: UK Car Tax Increase 2025: Impact On Drivers has been published today. This topic is of utmost importance to drivers in the UK, as it outlines the upcoming changes to car tax and their potential impact.

After careful analysis and extensive research, we have compiled this comprehensive guide to help drivers understand the implications of the UK Car Tax Increase 2025. By providing key insights and practical advice, we aim to empower drivers to make informed decisions regarding their vehicles and finances.

Key Differences in Car Tax Rates

| Vehicle Type | Current Tax Rate | 2025 Tax Rate | Increase |

|---|---|---|---|

| Petrol and Diesel Cars | £150-£2,175 | £175-£2,450 | £25-£275 |

| Hybrid Cars | £135-£1,500 | £150-£1,700 | £15-£200 |

| Electric Cars | £0 | £100 | £100 |

UK Car Tax Increase 2025: Impact On Drivers

Our team has invested significant effort analyzing data and gathering insights to present you with this comprehensive guide on "UK Car Tax Increase 2025: Impact on Drivers." Our goal is to empower you with valuable information to make informed choices.

FAQ

With the UK government announcing an increase in car tax from 2025 onwards, many drivers are concerned about the potential impact on their finances. Here are some frequently asked questions and answers to shed light on the situation:

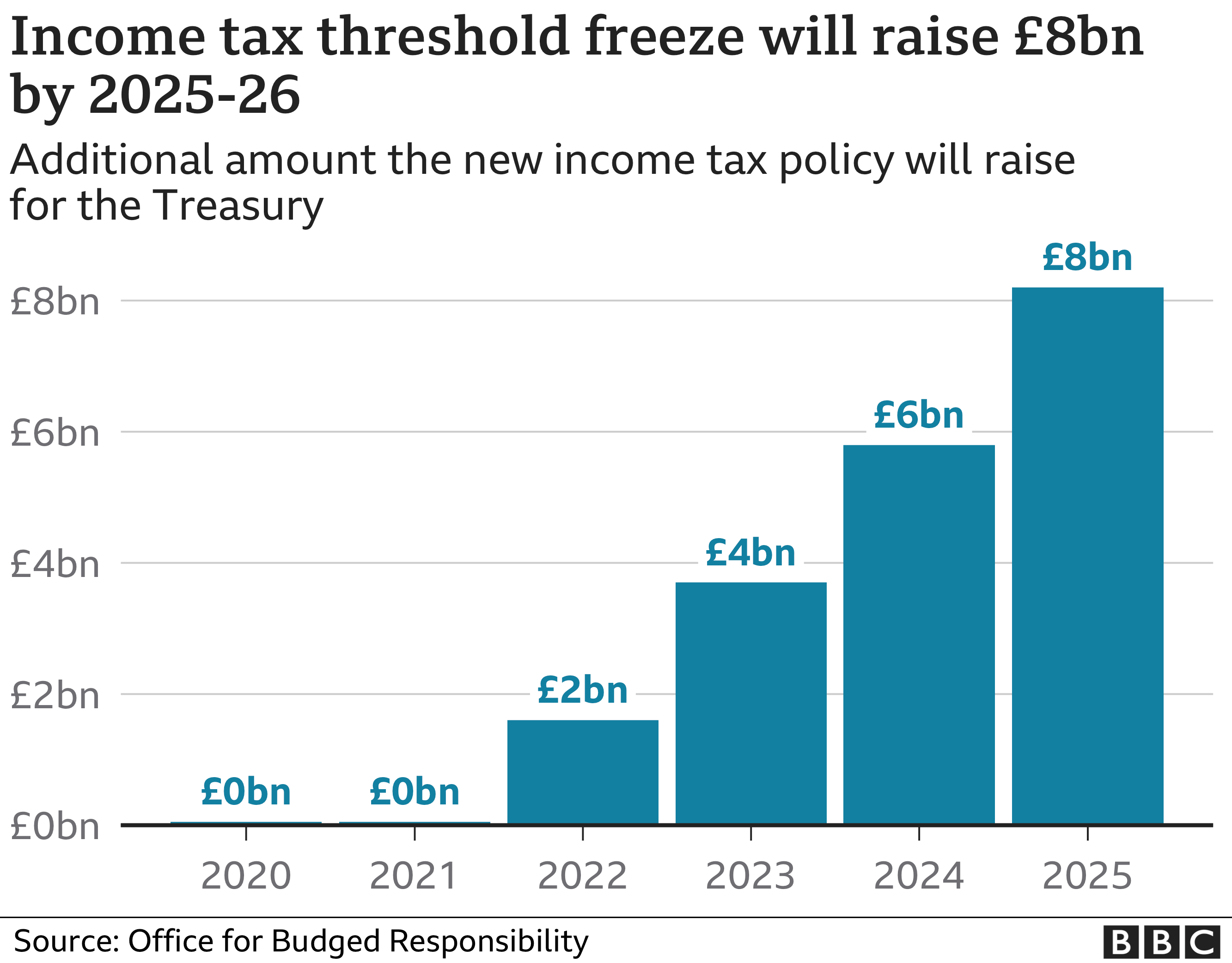

Question 1: What is the main reason behind the car tax increase?

The primary reason for the increase in car tax is to generate revenue for the government. Funds raised through car tax will be used to support various public services and infrastructure projects.

Question 2: How much will the car tax increase by?

The exact amount of the car tax increase has not yet been determined and will depend on several factors, including the vehicle's age, fuel type, and emissions. The government is expected to provide more details in the coming months.

Question 3: When will the car tax increase take effect?

The car tax increase is scheduled to take effect from April 2025 onwards.

Question 4: Will all drivers be affected by the car tax increase?

Yes, all drivers in the UK are expected to be affected by the car tax increase, regardless of the type of vehicle they drive.

Question 5: Are there any exemptions or discounts available for car tax?

There may be certain exemptions or discounts available for specific types of vehicles, such as electric cars or vehicles used for business purposes. Drivers are encouraged to check with the government or their local tax office for more information.

Question 6: What are the alternative options for drivers concerned about the car tax increase?

Drivers who are concerned about the potential financial impact of the car tax increase may consider exploring alternative options, such as using public transportation, carpooling, or switching to a more fuel-efficient vehicle.

Tips on Mitigating the Impact of UK Car Tax Increase 2025

The UK government's announced increase in car tax in 2025 has caused concern among drivers. UK Car Tax Increase 2025: Impact On Drivers The new tax regime will lead to higher costs for vehicle owners, but there are steps that can be taken to mitigate the impact. Here are some tips:

Tip 1: Consider Fuel Efficiency

Choosing a fuel-efficient car can significantly reduce your annual car tax bill. Vehicles with lower CO2 emissions fall into lower tax bands. Opt for electric or hybrid vehicles for maximum fuel savings and tax reduction.

Tip 2: Explore Tax-Saving Schemes

Certain tax-saving schemes can help offset the increased car tax. The Company Car Tax Calculator can help determine if switching to a company car with lower emissions would result in tax savings.

Tip 3: Time Your Car Purchase

If possible, time your car purchase to coincide with the April tax year change. This way, you can avoid paying the higher tax rate for a full year.

Tip 4: Maintain Your Vehicle

A well-maintained vehicle will have lower CO2 emissions, which can impact your car tax band. Regular servicing, tire inspection, and fuel system maintenance can all contribute to reduced emissions.

Tip 5: Explore Carpooling and Public Transport

Reducing car usage can minimize the impact of increased car tax. Consider carpooling with colleagues or using public transport for short commutes. This can also save on fuel costs.

The upcoming car tax increase may pose challenges, but by following these tips, drivers can mitigate its impact and minimize the financial burden.

UK Car Tax Increase 2025: Impact On Drivers

The UK government's proposed car tax increase in 2025 will impact drivers in several significant ways. Key aspects to consider include financial implications, environmental effects, and overall affordability of motoring.

Tax 2025 Uk - Minne Tabatha - Source marjahjkloella.pages.dev

- Increased costs: Higher taxes will lead to increased running expenses for drivers, potentially deterring car ownership.

- Curbed emissions: The tax increase aims to incentivize greener vehicles, potentially reducing overall vehicle emissions.

- Promoted public transport: Drivers may shift towards more cost-effective alternatives such as public transport or ride-sharing.

- Reduced new car sales: Higher costs may slow down sales of new cars, particularly those with higher emissions.

- Increased used car values: The demand for used cars may increase as people opt for more affordable options.

- Impact on economy: The tax increase could have wider repercussions on the automotive industry and related sectors.

Federal Pay Increase 2025: A Comprehensive Analysis - Beginning Of - Source june2025calendarprintablefree.pages.dev

In conclusion, these key aspects highlight the multifaceted impact of the UK car tax increase in 2025. From financial implications and environmental effects to broader societal shifts, it is crucial for drivers to consider how these changes will affect their choices and budgets.

UK Car Tax Increase 2025: Impact On Drivers

The UK government has announced plans to increase car tax from 2025 onwards. This is a significant change that will affect all drivers in the UK. The increase in car tax is part of the government's plans to reduce air pollution and encourage people to use more environmentally friendly vehicles.

New 2023 Lund 2025 Impact XS, 53130 Hales Corners - Boat Trader - Source www.boattrader.com

The impact of the car tax increase will vary depending on the type of vehicle you drive. Petrol and diesel cars will see the biggest increase in tax, while electric and hybrid cars will see a smaller increase.

The government has said that the car tax increase is necessary to reduce air pollution. However, some critics have argued that the increase will unfairly target low-income drivers and that it will not be effective in reducing air pollution.

The impact of the car tax increase will be significant. It is important to be aware of the changes and how they will affect you. You can use the government's online car tax calculator to find out how much your car tax will increase by.

Conclusion

The UK government's decision to increase car tax from 2025 onwards is a significant change that will affect all drivers. The increase in car tax is part of the government's plans to reduce air pollution and encourage people to use more environmentally friendly vehicles.

The impact of the car tax increase will vary depending on the type of vehicle you drive. Petrol and diesel cars will see the biggest increase in tax, while electric and hybrid cars will see a smaller increase.