In a society that emphasizes mobility, vehicles play a crucial role in providing independence and freedom for individuals with disabilities. Recognizing the challenges faced by this community, many countries offer tax exemptions on vehicles for people with disabilities.

Editor's Notes: "Tax Exemption On Vehicles For People With Disabilities" have published today date (DD/MM/YYYY). Tax Exemption On Vehicles For People With Disabilities guide aims to help understand the general concept & types of tax exemption on vehicles for people with disabilities.

Our team of experts has analyzed and researched different aspects of tax exemptions for people with disabilities. Keep reading to know more about the exemptions, criteria, and processes involved.

FAQs: Tax Exemption on Vehicles for People with Disabilities

Individuals with disabilities may qualify for a tax exemption on vehicles they use for transportation. This exemption aims to reduce the financial burden associated with mobility and provide individuals with greater independence. Here are some commonly asked questions and answers regarding this tax exemption:

Reserved Parking for Vehicles of People with Disabilities Stock Image - Source www.dreamstime.com

Question 1: Who is eligible for the tax exemption?

Individuals who meet the following criteria may be eligible:

- Have a permanent disability that impairs mobility.

- Use the vehicle primarily for transportation related to the disability.

Question 2: What types of vehicles qualify for the exemption?

Passenger cars, vans, or trucks that are specially equipped to accommodate the individual's disability may qualify. Examples include vehicles with wheelchair lifts, hand controls, or other adaptive features.

Question 3: How do I apply for the exemption?

Individuals should contact their local tax authority to obtain an application form. The application typically requires documentation of the disability and supporting documentation for the vehicle. Consult your tax advisor for proper guidance.

Question 4: What is the value of the exemption?

The exemption amount varies depending on the state or municipality. In some jurisdictions, the exemption is a percentage of the vehicle's purchase price, while in others, it is a fixed amount.

Question 5: Are there any time limits or restrictions on the exemption?

The exemption typically has no time limits. However, individuals may need to reapply periodically to verify their continued eligibility.

Question 6: Can I transfer the exemption to another vehicle?

Generally, the exemption is tied to the individual, not the vehicle. However, some jurisdictions may allow the transfer of the exemption to a new vehicle if certain conditions are met.

The tax exemption on vehicles for people with disabilities is a valuable benefit that can help ease the financial burden of transportation. By understanding the eligibility requirements and application process, individuals can maximize the benefits available to them.

For more information and specific details relevant to your circumstances, please consult your tax advisor or contact your local tax authority.

Tips For Tax Exemption On Vehicles For People With Disabilities

Obtaining a Tax Exemption On Vehicles For People With Disabilities can be a valuable way to save money on the purchase of a new vehicle. However, the process can be complex and time-consuming. Here are a few tips to help you get started:

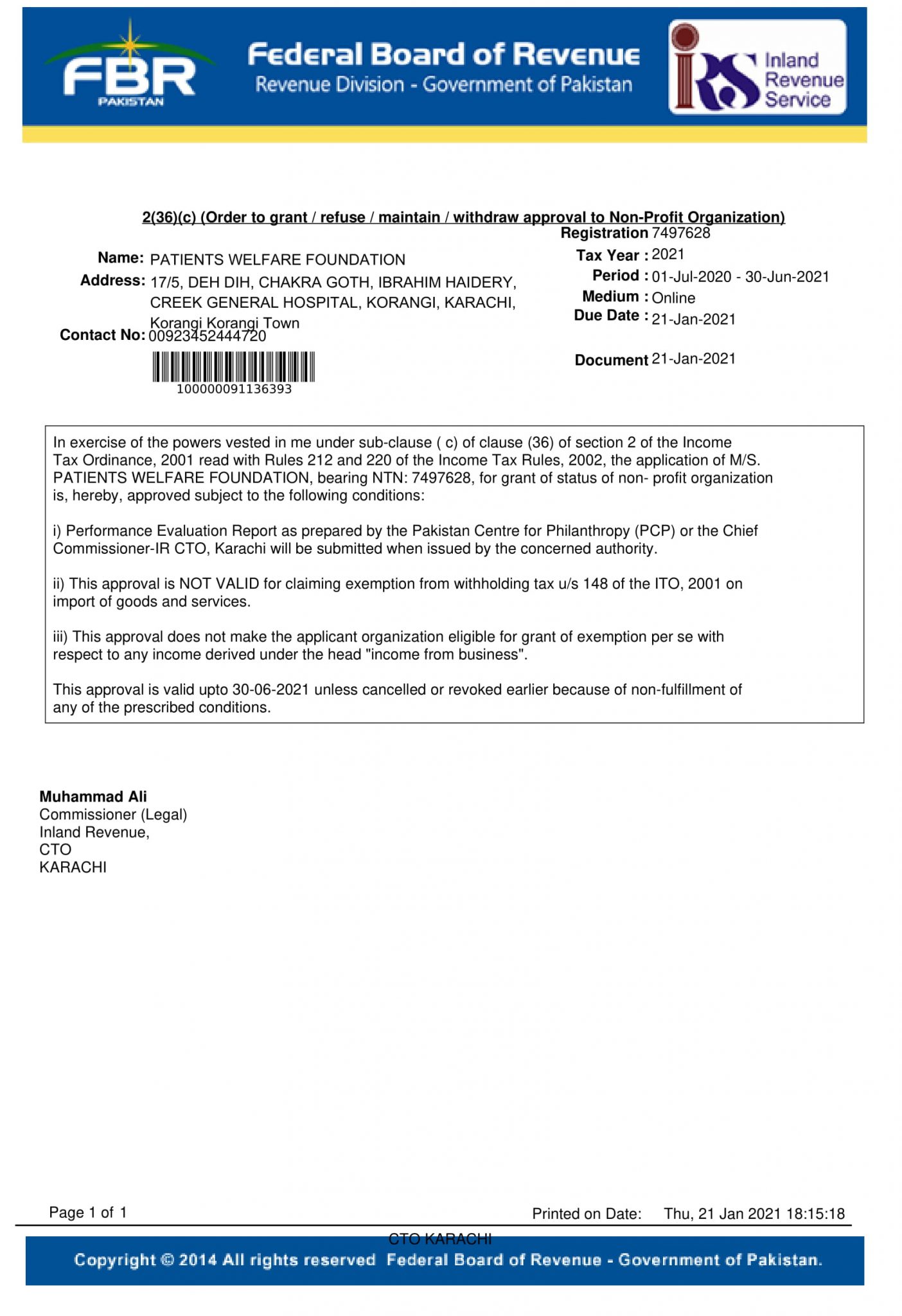

Tax Exemption Certificate – PWF Pakistan - Source pwfpakistan.org

Tip 1: Gather your documentation.

You will need to provide proof of your disability, such as a letter from your doctor. You will also need to provide proof of your income and assets. The specific requirements will vary depending on your state.

Tip 2: Apply for the exemption.

You can apply for the exemption online or by mail. The application process will vary depending on your state. You can find the application form on the website of your state's department of motor vehicles.

Tip 3: Be patient.

The application process can take several weeks or even months. Do not get discouraged if you do not receive a response right away.

Tip 4: Appeal if necessary.

If your application is denied, you can appeal the decision. The appeal process will vary depending on your state. You can find the appeal form on the website of your state's department of motor vehicles.

Tip 5: Get help if you need it.

There are many organizations that can help you apply for a Tax Exemption On Vehicles For People With Disabilities. These organizations can provide you with information and assistance throughout the application process.

Obtaining a Tax Exemption On Vehicles For People With Disabilities can be a valuable way to save money on the purchase of a new vehicle. By following these tips, you can increase your chances of success.

Tax Exemption On Vehicles For People With Disabilities

To reduce financial burdens, many countries offer tax exemptions on vehicles for individuals with disabilities. These exemptions acknowledge the unique challenges faced by such individuals and aim to enhance their mobility and independence.

Estate Tax Exemption 2024 Sunset Tax - Pavla Josephine - Source gigivludovika.pages.dev

- Legal qualifications: Defining eligibility criteria for individuals and vehicles.

- Vehicle modifications: Covering adaptations for wheelchair accessibility or specialized equipment.

- Sales and use tax exemptions: Eliminating taxes on vehicle purchases or usage.

- Rebates and grants: Providing financial assistance for vehicle acquisition or modification costs.

- Tax deductions: Allowing deductions for adaptive vehicle expenses on personal income taxes.

- International variations: Exploring diverse approaches to tax exemptions across different jurisdictions.

These key aspects demonstrate the varied dimensions of tax exemptions on vehicles for people with disabilities. They encompass legal frameworks, financial support, and international perspectives, highlighting the multifaceted nature of this important topic. By addressing the challenges faced by individuals with disabilities, these exemptions play a significant role in promoting their inclusion and empowerment. In many cases, a tax-exempt vehicle can be a lifeline, providing access to employment, education, healthcare, and social activities.

New Tax Exemption for Persons with Disabilities – NCD Guyana - Source www.ncdguyana.org

Tax Exemption On Vehicles For People With Disabilities

Tax exemptions on vehicles for people with disabilities are an important policy measure to help offset the additional costs associated with owning and operating a vehicle. For individuals with disabilities, having access to reliable transportation can be essential for maintaining their independence, employment, and overall quality of life. Tax exemptions can help make vehicles more affordable for these individuals, allowing them to participate more fully in society.

.jpg)

Tax Exemption for Persons with Disabilities in Kenya - Source www.myworkpay.com

In addition to the financial benefits, tax exemptions on vehicles for people with disabilities also have broader social and economic benefits. By making it easier for people with disabilities to get around, tax exemptions can help reduce their isolation and increase their opportunities for employment and social participation. This can lead to increased economic independence and reduced reliance on government assistance programs, ultimately benefiting both individuals and society as a whole.

There are a number of different ways in which tax exemptions on vehicles for people with disabilities can be implemented. Some jurisdictions offer a complete exemption from sales tax on the purchase of a new vehicle, while others offer a partial exemption or a rebate on the amount of sales tax paid. Some jurisdictions also offer tax exemptions on the annual registration fees for vehicles owned by people with disabilities.

The specific requirements for obtaining a tax exemption on a vehicle for people with disabilities vary from jurisdiction to jurisdiction. In general, however, individuals must be able to provide documentation of their disability, such as a letter from a врач or a disability card issued by the government. Department of Motor Vehicles (DMV)

Tax exemptions on vehicles for people with disabilities are an important policy measure that can help improve the quality of life for individuals with disabilities while also benefiting society as a whole. By making it easier for people with disabilities to get around, tax exemptions can help reduce their isolation and increase their opportunities for employment and social participation.

| Tax Exemption | Requirements | Benefits |

|---|---|---|

| Sales tax exemption | Documentation of disability | Reduced cost of purchasing a new vehicle |

| Registration fee exemption | Documentation of disability | Reduced annual cost of owning a vehicle |

| Rebate on sales tax | Documentation of disability | Refund of a portion of the sales tax paid |

Conclusion

Tax exemptions on vehicles for people with disabilities are a valuable policy tool to assist this population and promote their access to transportation. These exemptions not only provide financial relief but also facilitate independence, employment opportunities, and social engagement. By enabling individuals with disabilities to overcome transportation barriers, tax exemptions have a positive impact on their overall well-being and empower them to actively participate in society.

Moving forward, it is essential that governments continue to explore and implement innovative approaches to enhance tax exemption programs for vehicles specifically designed for people with disabilities. This includes streamlining the application process, expanding eligibility criteria, and considering additional tax breaks to make vehicles more affordable and accessible. By investing in policies that promote inclusivity and mobility, we can create a more equitable society where all individuals have the opportunity to thrive.