Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements is an essential resource for UK citizens approaching retirement or in the early stages of retirement.

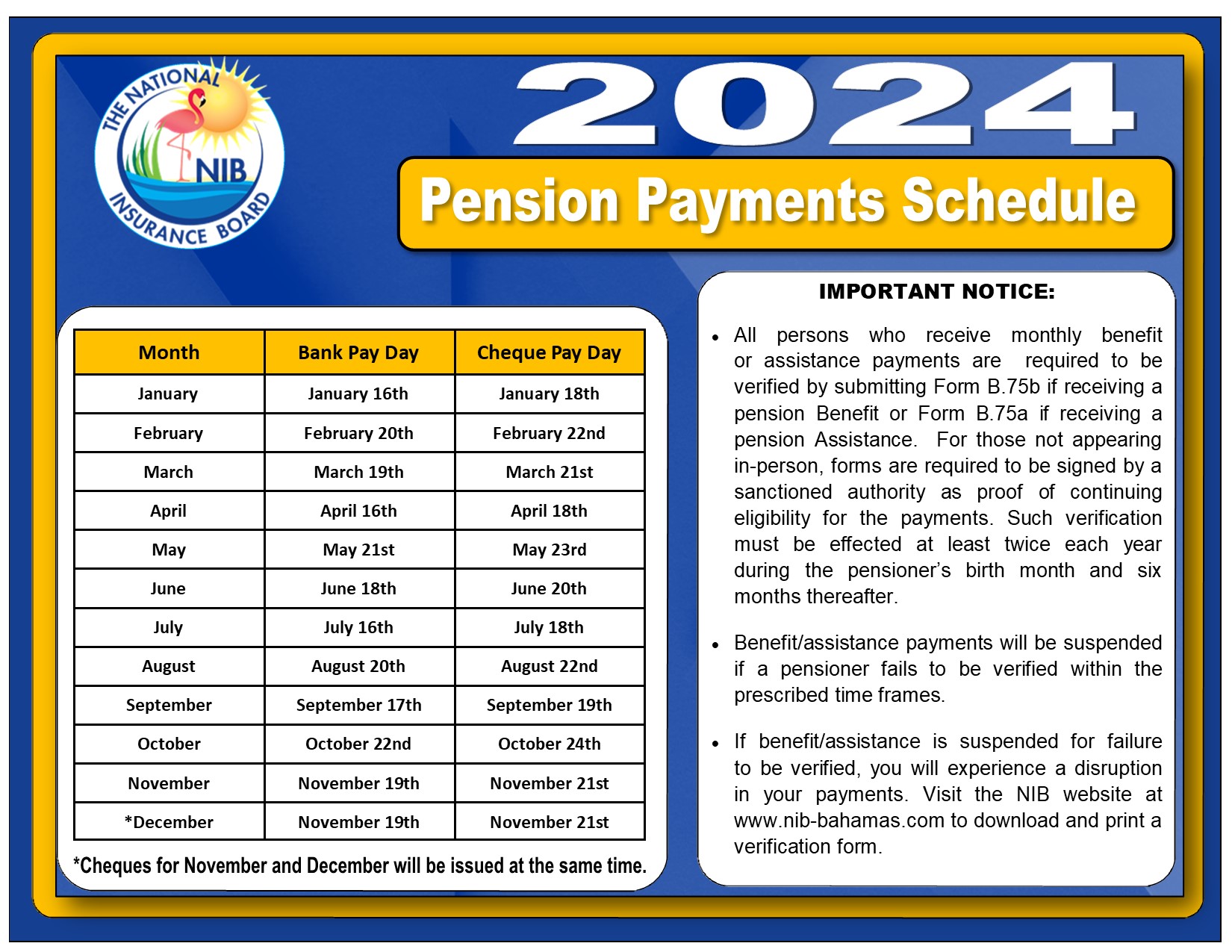

NIB 2024 Pension Payments Schedule - Source www.nib-bahamas.com

Editor's Notes: "Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements" have published today date". This topic is planned to publish due to having lots of enquiry on "Importance of pension", "How to get pension". People need to more aware on their pension, their benefits, eligibilities, payment methods and scheme.

To provide a comprehensive understanding of "Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements", we have analyzed, dug out information, and put together this Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements guide to help target audience make the right decision.

Key takeaways:

| Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements | Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements |

|---|---|

| This is a detailed guide to the UK state pension, covering eligibility, payments, and entitlements | This guide is essential reading for anyone approaching retirement or in the early stages of retirement |

| The guide is written in a clear and concise style, making it easy to understand | This guide is a valuable resource for anyone who wants to ensure they receive all the state pension benefits they are entitled to |

Main article topics:

FAQ

This comprehensive FAQ section provides concise answers to common questions regarding the State Pension, its eligibility criteria, payment details, and entitlements.

Question 1: Who is eligible for the State Pension?

The State Pension is available to individuals who have reached the State Pension age and have made the necessary National Insurance contributions.

Question 2: At what age can I claim the State Pension?

The State Pension age varies depending on the individual's date of birth. Generally, the State Pension age is currently 66 for both men and women, but it is gradually increasing in the coming years.

Question 3: How much is the State Pension?

The amount of the State Pension depends on factors such as the individual's National Insurance contribution record and whether they have deferred claiming the pension. For the 2023/24 tax year, the full weekly rate for the new State Pension is £190.60.

Question 4: Can I claim the State Pension while residing abroad?

In certain circumstances, individuals may be able to claim the State Pension while living overseas. However, eligibility depends on the individual's residence status, the country of residence, and the applicable reciprocal agreement.

Question 5: How can I check my State Pension forecast?

Individuals can obtain a State Pension forecast by visiting the government's online service. The forecast provides an estimate of the expected State Pension amount based on the individual's current National Insurance record.

Question 6: What happens if I have not made enough National Insurance contributions?

Individuals who have not made enough National Insurance contributions may not be entitled to the full State Pension. In such cases, they may receive a reduced pension or may have to wait until they reach a later age to claim the pension.

By understanding these key aspects, individuals can make informed decisions regarding their State Pension entitlements and plan accordingly for their retirement.

Next Article: Maximizing Your State Pension

Tips

To help navigate the complexities of the State Pension system, consider these tips to maximize benefits and entitlements.

Tip 1: Check eligibility early. Understanding eligibility criteria is crucial. Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements provides detailed information on age, National Insurance contributions, and other factors.

Tip 2: Maximize National Insurance contributions. Gaps in contributions can reduce pension payments. Ensure continuous contributions through employment or voluntary payments.

Tip 3: Consider deferring pension. Deferring the State Pension for a few years increases its value. However, weigh this option against potential financial needs.

Tip 4: Explore additional benefits. State Pension recipients may qualify for additional benefits such as Pension Credit, Housing Benefit, and Council Tax Reduction.

Tip 5: Plan for retirement. The State Pension is not sufficient to cover all retirement expenses. Supplement it with private savings, investments, or other income sources.

By following these tips, individuals can enhance their understanding of the State Pension and make informed decisions to secure a comfortable retirement.

Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements

State pensions play a significant role in ensuring financial security in retirement. This comprehensive guide delves into the essential aspects of eligibility, payments, and entitlements, providing a thorough understanding of this crucial system.

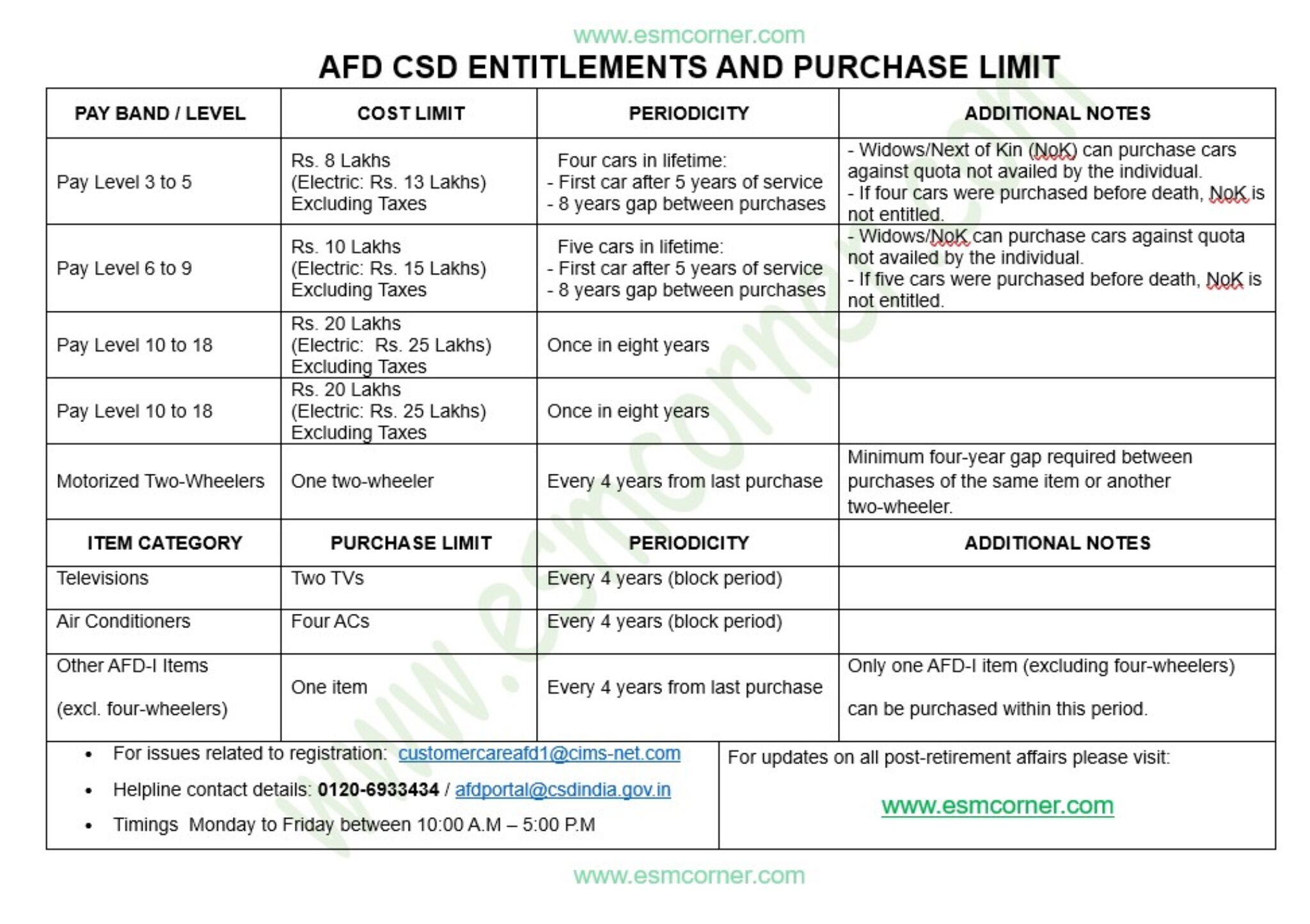

AFD CSD Portal Guide & FAQs: Eligibility, Purchases, & More - Source esmcorner.com

- Eligibility: Age, National Insurance contributions

- Payments: Amount, timing, frequency

- Entitlements: Spouse, survivor benefits

- Contributions: Required, voluntary, impact on entitlements

- Taxes: Implications, allowances

- Changes: Reforms, future updates

These key aspects are interconnected, and a clear understanding of each is crucial for informed decision-making. For instance, eligibility requirements ensure that only those who have contributed adequately receive payments. The amount of payments affects retirement income planning, while entitlements provide peace of mind for dependents. Contributions and taxes impact the size of the pension, while reforms may affect future benefits. Understanding these aspects empowers individuals to plan their retirement efficiently and navigate potential changes effectively.

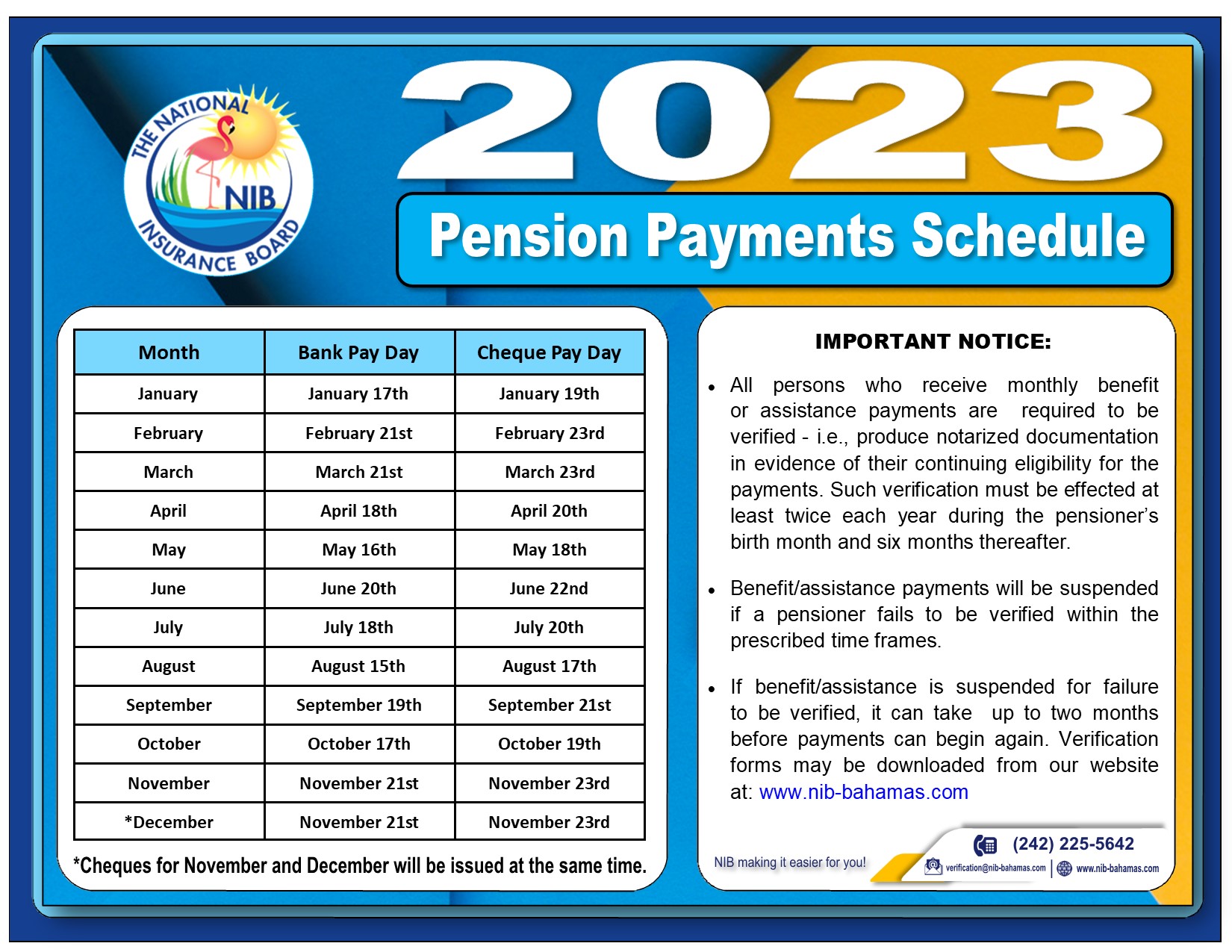

Winston Lloyd Kabar: State Pension Summary Phone Number - Source 165winstonlloydkabar.blogspot.com

Understanding The State Pension: A Comprehensive Guide To Eligibility, Payments, And Entitlements

Providing a comprehensive understanding of the State Pension is crucial as it serves as the foundation for retirement planning and financial security in old age. This guide delves into the eligibility criteria, payment structure, and various entitlements associated with the State Pension, empowering individuals to make informed decisions and plan for their future.

State Of Michigan Pension Payments 2024 - Edin Aeriela - Source quintanawruby.pages.dev

Understanding the State Pension enables individuals to assess their eligibility, calculate potential payments, and explore additional entitlements that may be available to them. This knowledge empowers them to make necessary adjustments to their retirement savings and financial planning, ensuring a secure and comfortable retirement.

Key insights from this guide include the following:

| Key Insight | Practical Significance |

|---|---|

| Understanding eligibility criteria ensures individuals know when they can start claiming their State Pension. | This enables them to plan their retirement accordingly and avoid any delays or penalties. |

| Grasping payment structure helps individuals estimate their potential income during retirement. | This knowledge allows them to adjust their savings and investments to supplement their State Pension. |

| Exploring entitlements provides individuals with a comprehensive view of all available benefits. | This ensures they can maximize their retirement income and access additional support if needed. |

Conclusion

Understanding the State Pension is paramount for retirement planning. This guide provides a comprehensive overview, empowering individuals to make informed decisions about their future financial security. Through eligibility assessment, payment calculations, and entitlement exploration, individuals can ensure a secure and fulfilling retirement.

Moving forward, it is crucial to stay informed about any changes or updates to the State Pension system. Regular reviews of one's financial situation and retirement goals will also help individuals adapt to evolving circumstances and make necessary adjustments.