Are you struggling to find a dependable and secure way to save for your future? National Savings & Investments (NS&I) may offer the solution you need. NS&I is a government-backed savings provider that offers a range of secure savings products designed to help you meet your financial goals.

Editor's Note: National Savings & Investments: Secure Savings For Your Future have published today date. This topic is important to read because it gives you insight on how o save your money for future.

After analyzing various options and conducting thorough research, we've compiled this comprehensive guide to National Savings & Investments: Secure Savings For Your Future. Our aim is to provide you with the information you need to make informed decisions about your savings and secure your financial future.

Key Differences:

| Type of Account | Interest Rate | Minimum Investment |

|---|---|---|

| Income Bond | 2.25% | £100 |

| Direct Saver | 1.00% | £1 |

| Premium Bond | Variable (up to 3%) | £25 |

Main Article Topics:

- Understanding National Savings & Investments

- Benefits of Saving with NS&I

- Types of Savings Accounts Offered

- How to Open an Account with NS&I

- Tips for Maximizing Your Savings

```html

FAQ

This FAQ section provides answers to common questions and misconceptions, offering valuable insights to comprehend our secure savings options and plan for a financially secure future.

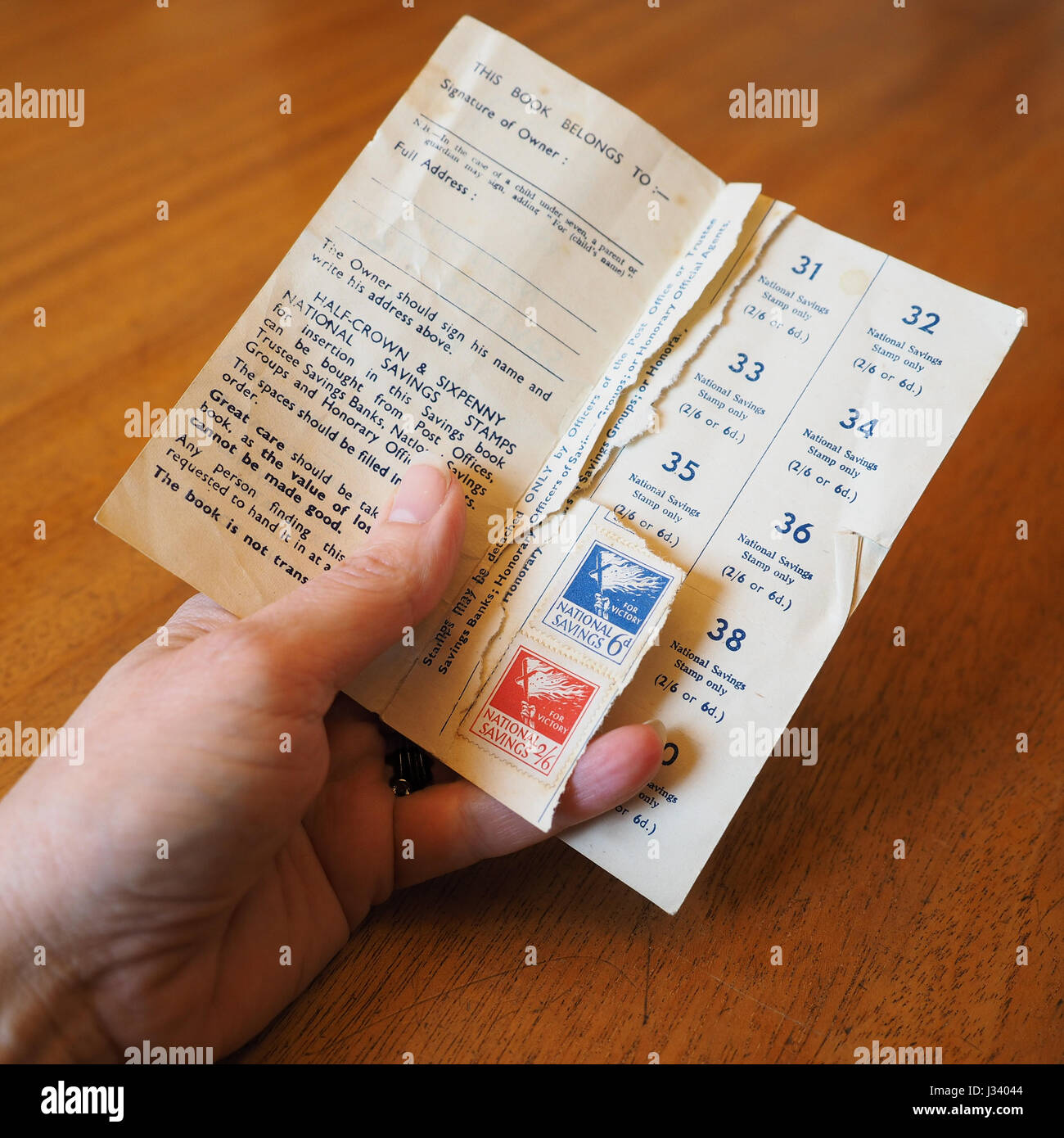

National Savings High Resolution Stock Photography and Images - Alamy - Source www.alamy.com

Question 1: What is the minimum amount I can invest with National Savings & Investments (NS&I)?

NS&I offers various savings products, each with its own minimum investment amount. For instance, Premium Bonds require a minimum investment of £25, while Income Bonds start at £500.

Question 2: How often does NS&I pay interest on my savings?

Interest payments vary depending on the savings product selected. Premium Bonds offer monthly interest draws, with prizes ranging from £25 to £1 million. Income Bonds pay interest annually, credited directly to your account.

Question 3: Is my money safe with NS&I?

NS&I is backed by the UK government, ensuring that your investments are protected. Your savings are held securely, and you can access them whenever necessary without any penalties.

Question 4: What are the tax implications of saving with NS&I?

Interest earned on NS&I savings is generally tax-free. However, for Premium Bonds, any winnings over £10,000 are subject to income tax. It's advisable to consult with a financial advisor for specific tax guidance.

Question 5: How do I open an NS&I account?

Opening an NS&I account is a simple process. You can apply online, by phone, or through the post. You will need to provide personal information, such as your name, address, and National Insurance number.

Question 6: What are the different types of savings accounts offered by NS&I?

NS&I offers a range of savings accounts to meet diverse financial goals. These include Premium Bonds, Income Bonds, Fixed Term Savings, Direct Saver, and Investment Accounts. Each account type has its unique features and interest rates.

By understanding these key questions and answers, you can make informed decisions about your savings and secure a financially stable future with National Savings & Investments.

Transitioning to the next article section...

```

Tips

Putting money aside in a savings account is a common way to manage finances. Savings can help you manage unexpected expenses, achieve your financial goals, and secure your financial future.

To make the most of your savings, consider these tips from National Savings & Investments: Secure Savings For Your Future.

Tip 1: Set financial goals

Having clear financial goals will help you determine how much you need to save and by when. Whether you're saving for a down payment on a house, a new car, or retirement, setting specific goals will motivate you to stick to your savings plan. Write down your goals and the amount you need to save for each one, and regularly review your progress.

Tip 2: Create a budget

Tracking your income and expenses will help you identify areas where you can save money. Knowing where your money goes will help you make informed decisions about your spending habits, allowing you to allocate more funds towards savings.

Tip 3: Automate your savings

Setting up automatic transfers from your checking account to your savings account will help you save consistently without having to rely on willpower. Determine a fixed amount that you can transfer regularly, and choose a day that aligns with your payday to ensure timely transfers.

Tip 4: Take advantage of high-yield savings accounts

Research and compare different savings accounts to find one that offers a competitive interest rate. A higher interest rate will help your money grow faster, allowing you to reach your savings goals sooner.

Tip 5: Consider a savings challenge

Joining a savings challenge can provide additional motivation and help you save more aggressively. There are various challenges available, such as the 52-week challenge, where you save a specific amount each week for a year.

Tip 6: Review your savings regularly

As your financial situation and goals change, it's important to review your savings plan and make adjustments accordingly. Check in on your savings progress regularly, and consider increasing your contributions or adjusting your savings strategy if necessary.

Tip 7: Don't be afraid to seek professional advice

If you struggle to manage your savings or have complex financial goals, consider consulting a financial advisor. A professional can provide personalized guidance and help you develop a comprehensive savings plan that aligns with your specific needs and circumstances.

Saving money is crucial for financial security and achieving your financial goals. By implementing these tips, you can create a solid savings plan that will help you build a secure financial future.

National Savings & Investments: Secure Savings For Your Future

National Savings & Investments (NS&I) offer a suite of savings accounts, each tailored to specific financial goals and risk appetites. Six key aspects to consider when evaluating NS&I accounts are security, flexibility, accessibility, returns, tax implications, and customer service.

- Security: NS&I accounts are backed by the UK government, ensuring the safety of your savings.

- Flexibility: Accounts offer varying degrees of access to funds, from instant to fixed terms.

- Accessibility: NS&I accounts can be opened online, by post, or over the phone.

- Returns: NS&I accounts offer competitive interest rates and returns, comparable to market benchmarks.

- Tax implications: Interest earned on NS&I accounts may be subject to taxation, depending on individual circumstances.

- Customer service: NS&I provides dedicated customer support through various channels, including phone, email, and online chat.

These aspects are interconnected and should be carefully considered when selecting an NS&I account. For instance, if security is paramount, NS&I's government backing offers peace of mind. If flexibility is desired, accounts with instant access to funds may be suitable. By understanding these key aspects, individuals can make informed decisions to safeguard their savings and work towards their financial goals with confidence.

National Savings Book High Resolution Stock Photography and Images - Alamy - Source www.alamy.com

National Savings & Investments: Secure Savings For Your Future

National Savings & Investments (NS&I) is a government-backed savings and investments institution in the United Kingdom. It offers a range of savings and investments products, including Premium Bonds, Income Bonds, Investment Accounts, and Fixed Rate Savings Bonds. NS&I products are considered to be low-risk, as they are backed by the UK government. As a result, they are often recommended for people who are looking for a safe place to save their money.

National Savings and Investments Head Office UK - Phone Number & Address - Source corporateofficeheadquarters.org

NS&I products are available to anyone who is resident in the UK. You can open an account online, by phone, or by post. There are no minimum or maximum investment amounts, and you can withdraw your money at any time without penalty.

NS&I products are a good way to save for your future. They offer a competitive rate of return, and they are backed by the UK government. As a result, they are a low-risk way to save for your retirement, your children's education, or any other long-term goal.

If you are looking for a safe and secure place to save your money, then NS&I is a good option to consider. Its products are backed by the UK government, and they offer a competitive rate of return.

| Product | Interest Rate | Minimum Investment |

|---|---|---|

| Premium Bonds | 1.40% | £1 |

| Income Bonds | 1.15% | £500 |

| Investment Accounts | 0.70% | £1 |

| Fixed Rate Savings Bonds | 2.25% | £500 |