Save On Labour Taxes With Labour Tax Flights

Editor's Notes: "Save On Labour Taxes With Labour Tax Flights" have published today date". This topic important to read because reader will get an information how to save on labour taxes.

After doing some analysis, digging information, made Save On Labour Taxes With Labour Tax Flights we put together this Save On Labour Taxes With Labour Tax Flights guide to help target audience make the right decision.

FAQs on Saving on Labour Taxes with Labour Tax Flights

This FAQ section provides comprehensive answers to commonly asked questions about the Labour Tax Flight strategy. Read on to clarify any misconceptions and gain a deeper understanding of the opportunities and benefits it offers.

Question 1: What is a Labour Tax Flight?

A Labour Tax Flight is a legal strategy where a business restructures its operations by separating labour-intensive processes into a separate entity located in a jurisdiction with lower labour taxes. This enables the business to reduce overall labour costs and optimize tax efficiency.

Free Labour day Activities Template - Edit Online & Download | Template.net - Source www.template.net

Question 2: Is a Labour Tax Flight right for every business?

No, a Labour Tax Flight may not be suitable for all businesses. It is particularly beneficial for companies with significant labour costs and operations that can be easily separated into independent entities. Factors such as industry, business structure, and tax implications should be carefully considered before implementing this strategy.

Question 3: What are the benefits of a Labour Tax Flight?

A Labour Tax Flight offers numerous benefits, including reduced labour costs, tax optimization, increased competitiveness, and improved cash flow. By relocating labour-intensive operations to a lower-tax jurisdiction, businesses can significantly reduce their overall labour expenses and gain a competitive edge in the market.

Question 4: What are the potential risks of a Labour Tax Flight?

As with any business strategy, there are potential risks associated with a Labour Tax Flight. These include increased operational complexity, potential legal liabilities, and the need for careful planning and execution. It is crucial to conduct thorough due diligence and engage qualified professionals to ensure a successful implementation.

Question 5: Is a Labour Tax Flight legal?

Yes, a Labour Tax Flight is entirely legal when properly structured and implemented. It is important to seek professional advice and comply with all applicable laws and regulations in both the home and destination jurisdictions.

Question 6: How does a Labour Tax Flight compare to other tax optimization strategies?

A Labour Tax Flight offers unique advantages compared to other tax optimization strategies. It focuses specifically on reducing labour costs, rather than just shifting taxable income. By relocating labour-intensive operations, businesses can achieve substantial savings that extend beyond traditional tax planning measures.

In conclusion, a Labour Tax Flight can be a valuable strategy for businesses seeking to reduce labour taxes and enhance their financial performance. However, it should be carefully assessed and implemented with the guidance of qualified professionals to mitigate risks and ensure its success.

For more information and personalized advice, consult with a reputable tax advisor or international business consultant.

Tips for Saving on Labour Taxes with Labour Tax Flights

Labour tax flights, also known as labour tax relief flights, can help businesses save money on labour taxes by taking advantage of tax incentives offered by certain jurisdictions.

Tip 1: Research and identify eligible jurisdictions.

Not all jurisdictions offer tax incentives for labour tax flights. Research and identify jurisdictions that have favourable tax rates and policies for businesses relocating employees.

Tip 2: Meet the eligibility criteria.

Each jurisdiction may have specific eligibility criteria that businesses must meet to qualify for tax incentives. These criteria can include the number of employees relocated, the duration of the relocation, and the type of business activities conducted.

Tip 3: Determine the tax savings.

Calculate the potential tax savings by comparing the labour tax rates in the current jurisdiction with the rates in the target jurisdiction. Consider the total cost of relocating employees, including transportation, housing, and other expenses.

Tip 4: Consider the long-term impact.

While labour tax flights can provide short-term tax savings, businesses should also consider the long-term impact on employee morale, productivity, and customer relationships. Relocation can be disruptive, and it is important to ensure that the move benefits both the business and its employees.

Tip 5: Seek professional advice.

Consult with tax professionals and legal counsel to ensure compliance with all relevant laws and regulations. They can help you navigate the complex process of labour tax flights and optimize your tax savings.

Labour tax flights can be a valuable tool for businesses looking to reduce their labour tax burden. By carefully researching, planning, and following the tips above, businesses can maximize their tax savings and gain a competitive advantage.

For more information, refer to the article Save On Labour Taxes With Labour Tax Flights.

Save On Labour Taxes With Labour Tax Flights

For businesses seeking cost optimization, utilizing Labour Tax Flights can provide substantial savings on labour costs. These flights, legally compliant and tailored to specific business needs, leverage tax regulations and strategic planning to minimize tax liabilities. Exploring the essential aspects of Labour Tax Flights reveals the multifaceted benefits they offer.

- Tax Exemption: Specific destination countries offer tax exemptions on labour costs for foreign workers.

- Tax Breaks: Labour Tax Flights optimize payroll structures to maximize deductions and allowances.

- Reduced Social Contributions: Certain jurisdictions reduce or eliminate social security contributions for foreign workers.

- Labour Cost Arbitrage: Flights exploit lower labour costs in destination countries compared to home countries.

- Increased Productivity: Purpose-built flight destinations promote efficient working environments and enhance productivity.

- Compliance Assurance: Labour Tax Flights are designed to comply with all applicable laws and regulations.

These key aspects collectively demonstrate the ability of Labour Tax Flights to significantly reduce labour costs. By utilizing tax loopholes, optimizing payroll structures, and leveraging cost arbitrage, businesses can achieve substantial savings while maintaining compliance. Furthermore, the increased productivity and efficiency gained from flights add to the overall cost-effectiveness of this strategy.

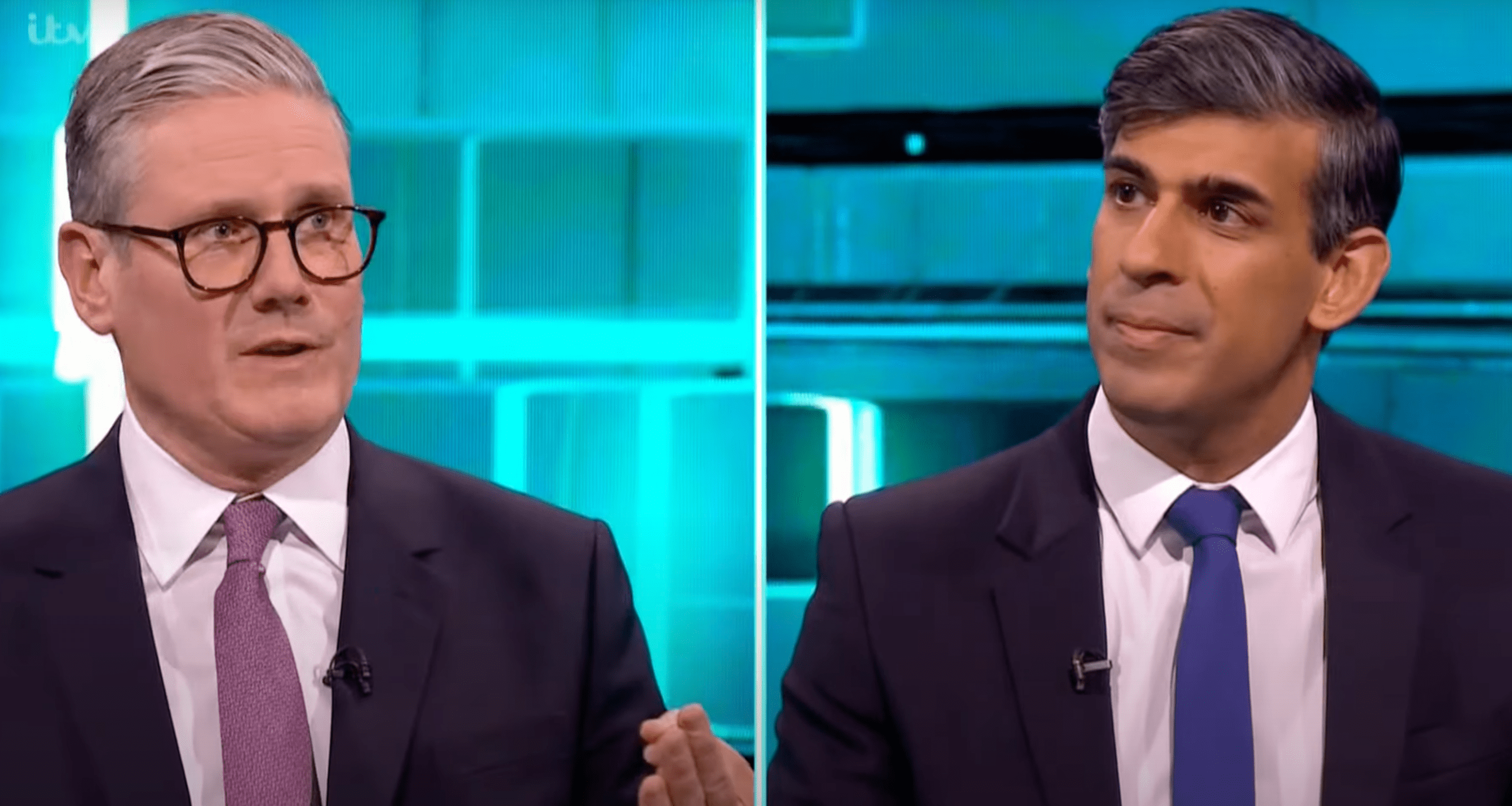

Will Labour raise taxes? Sunak 'lied' over Labour's '£2k tax rise - Source www.bigissue.com

Save On Labour Taxes With Labour Tax Flights

The connection between "Save On Labour Taxes With Labour Tax Flights" is that labour tax flights are a way for businesses to reduce their labour taxes. By flying employees to a country with lower labour taxes, businesses can save money on their payroll costs. This can be a significant benefit for businesses with a large number of employees or for businesses that operate in countries with high labour taxes.

Happy Labour Day - Sewing Machine Vancouver, Mason Sewing Machine (604 - Source www.masonsewingmachine.com

Labour tax flights are a controversial topic. Some people argue that they are a form of tax avoidance and that they allow businesses to unfairly reduce their tax burden. Others argue that labour tax flights are a legitimate way for businesses to save money and that they help to create jobs in developing countries.

The practical significance of understanding the connection between "Save On Labour Taxes With Labour Tax Flights" is that it can help businesses to make informed decisions about their tax planning. Businesses should be aware of the potential benefits and drawbacks of labour tax flights and should weigh these factors carefully before making a decision.

| Pros | Cons |

|---|---|

| Reduced labour taxes | Increased travel costs |

| Improved profitability | Potential tax penalties |

| Job creation in developing countries | Ethical concerns |

Conclusion

Labour tax flights are a complex issue with both benefits and drawbacks. Businesses should carefully consider all of the factors involved before making a decision about whether or not to use them.

The use of labour tax flights is likely to continue to be a controversial issue. However, by understanding the connection between "Save On Labour Taxes With Labour Tax Flights", businesses can make informed decisions about their tax planning and take advantage of the potential benefits while minimizing the risks.