Have you heard the latest news? UK Inflation has risen to a record high for the past 40 years. Keep reading to learn more about this important topic.

Editor's Notes: "UK Inflation Hits 40-year High Of 10.1%" have published today, July 13, 2022. Understanding the UK Inflation Hits 40-year High Of 10.1% is important because it can impact your financial decisions.

To give you a better understanding of UK Inflation Hits 40-year High Of 10.1%, our team has gathered the following information for you.

| Key Differences | UK Inflation Hits 40-year High Of 10.1% |

|---|---|

| Date Published | July 13, 2022 |

| Category | UK Inflation |

| Reason for increase | Rising energy prices |

| Impact | Increased cost of living |

FAQ

As the United Kingdom grapples with soaring inflation, it's critical to address some common concerns and misconceptions. Below are answers to frequently asked questions regarding the recent rise in inflation to 10.1%, the highest in 40 years.

Inflation hits new 40-year high at 9.4% amid cost-of-living squeeze - Source www.itv.com

Question 1: What is driving the record-high inflation?

Inflation has been primarily driven by factors such as supply chain disruptions stemming from the COVID-19 pandemic and the Russia-Ukraine conflict. These disruptions have led to shortages of essential goods and commodities, pushing prices upward.

Question 2: How is inflation affecting consumers?

Rising inflation is eroding consumers' purchasing power, making it more expensive for them to afford basic necessities such as food, energy, and housing. This is particularly concerning for low-income households who spend a larger proportion of their income on these essential items.

Question 3: What is the government doing to address inflation?

The government has introduced various measures to combat inflation, including raising interest rates to curb consumer spending and slowing economic growth. Additionally, it has implemented targeted support packages for vulnerable households.

Question 4: How long is inflation expected to last?

The duration of the current inflation surge is difficult to predict, but most economists believe it could persist for a while longer. The conflict in Ukraine and ongoing supply chain issues continue to pose significant challenges in stabilizing prices.

Question 5: What can consumers do to cope with rising inflation?

Consumers can consider adjusting their spending habits to prioritize essential purchases and exploring ways to reduce household expenses. Additionally, seeking financial advice and support from qualified professionals can be beneficial in navigating this challenging period.

Question 6: How will inflation impact the economy in the long term?

Sustained high inflation can have detrimental effects on the economy, potentially leading to a decline in investment and economic growth. It can also erode confidence in the currency and destabilize financial markets.

In conclusion, the current high inflation in the UK is a complex issue with various contributing factors. The government and consumers are taking proactive measures to address its impact, while recognizing that inflation may remain a challenge for some time. Seeking informed advice and staying abreast of economic developments can help individuals navigate the current economic landscape.

Moving to the next section: The Economic Impact of Inflation

Tips to Financially Cope with Inflation

With the UK Inflation Hits 40-year High Of 10.1%, it's crucial to stay financially afloat. Here are some tips to weather the inflationary storm:

Tip 1: Review Expenses and Cut Unnecessary Spending

Analyze expenses to identify non-essential items that can be eliminated or reduced. This includes subscriptions, entertainment, and luxury purchases.

Tip 2: Negotiate Lower Bills and Rates

Contact service providers (e.g., phone, internet, utilities) to negotiate lower rates or payment plans that ease the financial burden.

Tip 3: Explore Additional Income Streams

Consider part-time employment, freelance work, or starting a side hustle to supplement income and offset rising expenses.

Tip 4: Prioritize Debt Repayment

Focus on repaying high-interest debt while making minimum payments on low-interest debt. This strategy helps reduce interest charges and frees up cash flow.

Tip 5: Consider Refinancing

If interest rates are lower than your current mortgage or loan rates, refinancing can reduce monthly payments and save money in the long run.

Summary of key takeaways or benefits

By implementing these tips, individuals can mitigate the impact of inflation on their finances, reduce expenses, and potentially increase income.

Transition to the article's conclusion

While inflation poses challenges, these practical tips empower individuals to navigate the situation effectively and ensure financial stability amidst rising prices.

UK Inflation Hits 40-year High Of 10.1%

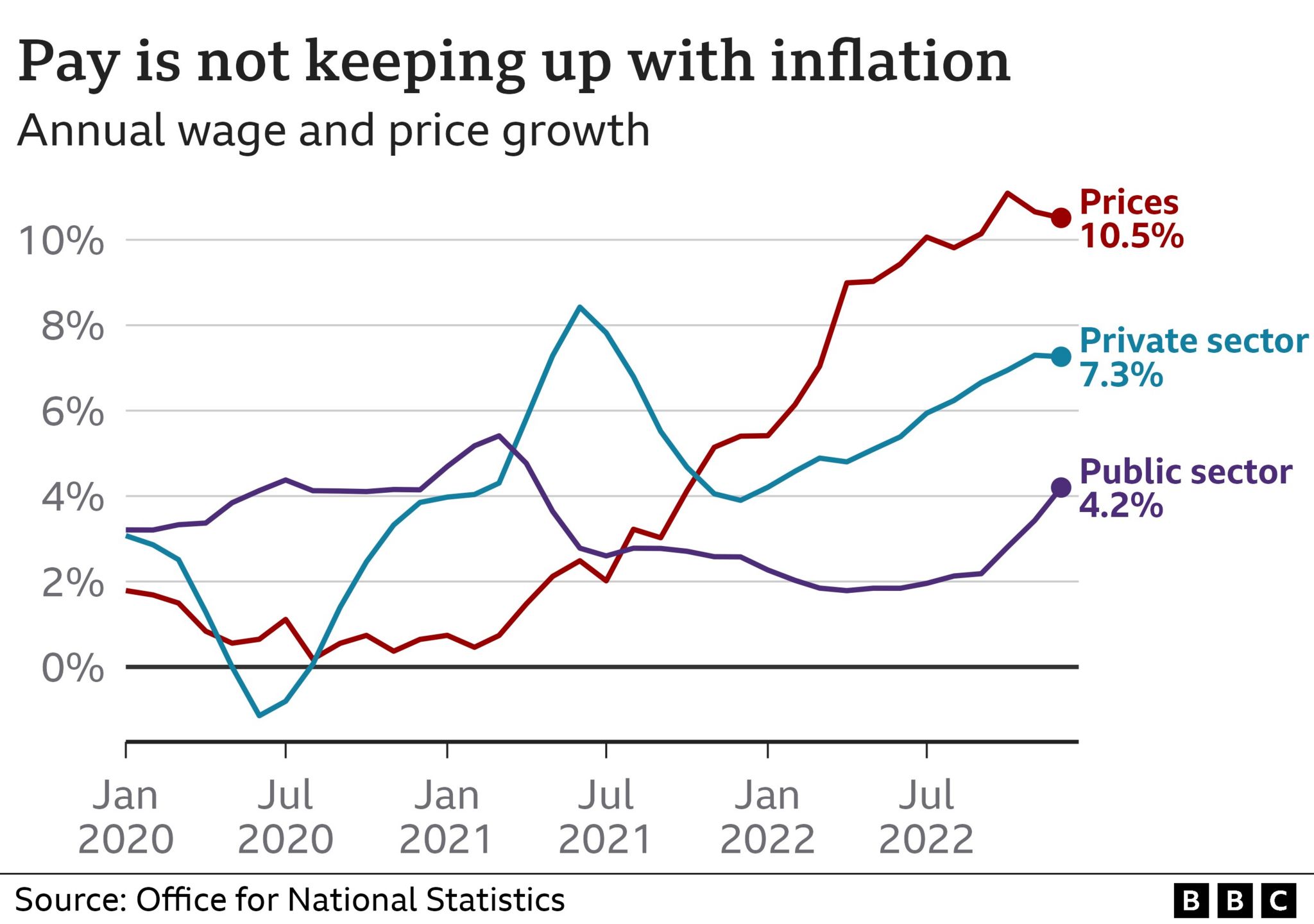

UK inflation has reached a 40-year high, driven by a combination of factors including rising energy prices and supply chain disruptions. This has had a significant impact on various aspects of the economy and daily life.

- Rising cost of living: Inflation has led to a sharp increase in the cost of goods and services, putting a strain on household budgets.

- Pressure on businesses: Businesses are facing higher input costs, which are eroding profit margins and forcing some to raise prices.

- Impact on consumers: Reduced consumer spending is a potential risk as individuals prioritize essential expenses.

- Government response: The government is implementing measures to mitigate the impact of inflation, such as providing financial assistance to households.

- Central bank actions: The Bank of England has raised interest rates to curb inflation, but this could slow economic growth.

- Long-term consequences: Sustained high inflation can lead to a loss of confidence in the economy and impact investment decisions.

Soaring food prices push UK inflation back to 40-year high - Source www.rappler.com

For instance, the rising cost of energy has contributed significantly to inflation, with gas and electricity prices soaring in recent months. This has put a particular burden on low-income households and those living in energy-inefficient homes. Additionally, supply chain disruptions have caused shortages of certain goods, further driving up prices. The impact of inflation is not just economic; it also has social and political implications, as it can erode trust in the government and lead to social unrest.

UK Inflation Hits 40-year High Of 10.1%

The United Kingdom's inflation rate has hit a 40-year high of 10.1%, the highest level since February 1982. This sharp rise in inflation is due to a number of factors, including the ongoing COVID-19 pandemic, the war in Ukraine, and supply chain disruptions.

Current Inflation Rate 2024 Uk Inflation Rate - Mandy Aveline - Source birgityaindrea.pages.dev

The rising inflation rate is a major concern for the UK government and the Bank of England. It is eroding the purchasing power of consumers and businesses, and it is making it more difficult for people to save for the future. The Bank of England has raised interest rates in an effort to curb inflation, but it is unclear how effective this will be.

The high inflation rate is also having a significant impact on the UK economy. It is making it more difficult for businesses to operate and it is discouraging investment. The government is concerned that the high inflation rate could lead to a recession.

The UK government and the Bank of England are taking steps to address the high inflation rate, but it is unclear how effective these measures will be. It is likely that the high inflation rate will persist for some time, and it is important for consumers and businesses to be prepared for the challenges that this will bring.

| Cause | Effect |

|---|---|

| COVID-19 pandemic | Supply chain disruptions |

| War in Ukraine | Rising energy prices |

| Brexit | Trade barriers |

Conclusion

The UK's high inflation rate is a major concern for the government and the Bank of England. It is eroding the purchasing power of consumers and businesses, and it is making it more difficult for people to save for the future. The Bank of England has raised interest rates in an effort to curb inflation, but it is unclear how effective this will be.

The high inflation rate is also having a significant impact on the UK economy. It is making it more difficult for businesses to operate and it is discouraging investment. The government is concerned that the high inflation rate could lead to a recession.

The UK government and the Bank of England are taking steps to address the high inflation rate, but it is unclear how effective these measures will be. It is likely that the high inflation rate will persist for some time, and it is important for consumers and businesses to be prepared for the challenges that this will bring.